Analysts’ recommendations regarding PZU stock

Equities and Bonds

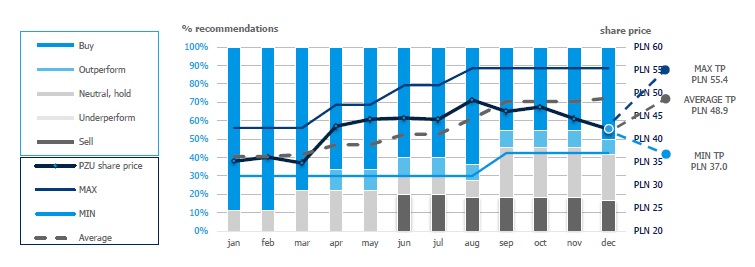

In 2017, PZU stock recommendations were issued by 13 domestic and international financial institutions. In total, sell side analysts GLOSSARY issued 22 recommendations. The greatest percentage of issued recommendations were positive (50%) and neutral (40.1%).

At the end of 2017, PZU had 12 current recommendations (7 buy, 3 hold and 2 sell). The median of their price targets was PLN 51.1 and was 41.8% higher than the median price at the beginning of the year. The maximum target price was PLN 55.4 and was 14.0% higher than the maximum target price at the beginning of January 2017. At the end of 2017, analysts perceived PZU’s shares as highly undervalued. Median target price provided by analysts was 21.1% higher than the price at the end of 2017.

In 2017, in their recommendations, analysts focused mostly on evaluating the impact that the growing share of the banking segment in PZU Group has on the company’s results and stock market valuation, better prospects in property insurance due to the improved situation on the motor insurance market, sustainability of the high-margin business model of group insurance and individually continued insurance and the impact of the investment result on PZU’s profits in connection with the situation on financial markets.

Statistics related to the recommendations issued in 2017

Almost throughout 2016, the spread between the average target price in recommendations and the current share price was roughly 20% above the market price of PZU shares. Following the rapid increase in PZU share prices at the end of 2016, the difference narrowed down to a few percent and only slightly differed from the current share price, also in Q1 2017. In April 2017, the price of PZU shares started to appreciate sharply to about 10% more than the average prices expected by analysts. As a result, analyst valuations also started to trend upward. In August 2017, the maximum target price reached 55.4 (21% above the market price at the time of issuing the recommendation), while the average target price increased to PLN 44.5. In the last quarter of 2017, after a strong increase, the target price was again above the market valuation of PZU shares. At the end of 2017, the average recommendation price was 16% above the market price of the shares at market closing on 31 December 2017.

Price variance of the recommendations in 2017

| 31.12.2017 | 01.01.2017 | change | Price variance of the recommendations from the share price at the end of 2017 | |

| Highest target price | 55,4 | 48,6 | 14,0% | 31,4% |

| Median of the target prices | 51,1 | 36,0 | 41,8% | 21,1% |

| Average of the target prices | 48,9 | 38,9 | 25,9% | 16,0% |

| Lowest target price | 37,0 | 30,9 | 19,7% | -12,2% |

Analysts’ expectations towards the price of PZU shares in 2017 based on recommendations in effect at the end of December 2017

Institutions issuing recommendations for PZU shares in 2017 (as at the end of December 2017)

Poland

| Institution | Analyst | Contact data |

| Citi | Andrzej Powierża | +48 22 690 35 66 |

| andrzej.powierza@citi.com | ||

| Ipopema | Łukasz Jańczak | +48 22 236 92 30 |

| lukasz.janczak@ipopema.pl | ||

| mBank | Michał Konarski | +48 22 697 47 37 |

| michal.konarski@mdm.pl | ||

| PKO BP | Jaromir Szortyka | +48 22 580 39 47 |

| jaromir.szortyka@pkobp.pl | ||

| Trigon | Maciej Marcinowski | +48 22 4338 375 |

| maciej.marcinowski@trigon.pl | ||

| Wood & Company | Marta Jeżewska-Wasilewska | +48 22 222 15 48 |

| marta.jezewska-wasilewska@wood.com |

Abroad

| Institution | Analyst | Contact data |

| Deutsche Bank | Larissa van Deventer | +27 11 775 7049 |

| larissa.van-deventer@db.com | ||

| ERSTE | Thomas Unger | +43 50 1001 7344 |

| thomas.unger@erstegroup.com | ||

| HSBC | Dhruv Gahlaut | +44 20 7991 6728 |

| Dhruv.gahlaut@hsbcib.com | ||

| JP Morgan | Michael Huttner | +48 22 44 19534 |

| michal.kuzawinski@jpmorgan.com | ||

| Raiffeisen Centrobank | Bernd Maurer | +43 1 51520 706 |

| maurer@rcb.at | ||

| UBS | Michael Christelis | +27 11 322 7320 |

| michael.christelis@ubs.com |