Equity and bond market

Equities and Bonds

In 2017, investors continued to focus their attention on central banks which, in line with expectations, kept applying an accommodative monetary policy in an environment of weak inflation. However, in contrast with the previous year, the financial markets did not undergo any serious turbulence associated with greater risks resulting from geopolitical tensions. A series of elections in key European Union countries brought outcomes suppressing the risk of disintegration of the EU and the euro area, and the last months of the year were marked by a declining risk of a ‘hard Brexit’. Nor did the concerns about a significant increase in protectionist policies in the global economy materialize. Of only minor importance to the financial markets were such events such as the proclamation of independence by Catalonia or the escalation of the nuclear program in North Korea. As a result, the economic context fostered many asset classes, and above all equities. However, the rapidly increasing appetite for risk among investors did not ignite a sell-off of safe assets. Yields on 10- year T-bonds of major developed economies ended the year at levels similar to those at the beginning of the year.

Upward trends on the equity markets persisted in both developed and emerging markets. Most global markets more than made up for the losses suffered after the financial crunch of 2007-2008. In 2017, the MSCI ACWI (All Country World Index), based on stocks from 46 different countries, of which 23 are classified as developed markets and the remaining 23 are considered emerging markets, hiked up 21.6%, setting a record high of 513 points (USD) at the end of the year, which was roughly 20% more than the peaks prior to the collapse of the global economy in 2008-2009. Many economists ascribed this global recovery to the high degree of synchronization between the constituent parts of the world economy, from economic and geographic perspectives alike.

The largest beneficiary of this improved economic situation on the global markets was the United States where the main stock market indices climbed to their historical highs. Downward corrections of stock prices were shallow and limited in coverage, and trading on the stock markets was accompanied by declining volatility (measured by the VIX index – see the GLOSSARY for the Fear Index).

Risk appetite was not weakened even by the Fed’s three interest rate hikes in 2017 (to 1.25-1.50%) or the announcement of three more hikes in 2018 of 25 basis points each, or the decision made by the Federal Open Market Committee (FOMC) to launch a balance sheet value reduction program, that is to reverse the effects of the quantitative easing (QE) policy applied in 2008-2013. The economic recovery was backed by fundamental advances as companies kept improving their performance from quarter to quarter. In the wake of these developments, analysts’ forecasts for the coming years were more and more optimistic.

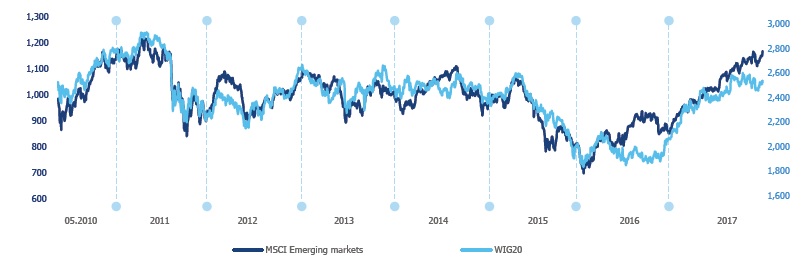

The upturn on developed markets translated into higher valuations on emerging markets (including Poland). In 2017, the dollar-denominated MSCI Emerging Markets index (historically strongly correlated with the WIG20 index) continued the upward trend it embarked on already in 2016, recording an increase by 34.3% y/y, or 7.9 percentage points higher than WIG20 (26.4% y/y).

WIG20 / MSCI Emerging Markets

Source: www.msci.com, www.gpwinfostrefa.pl

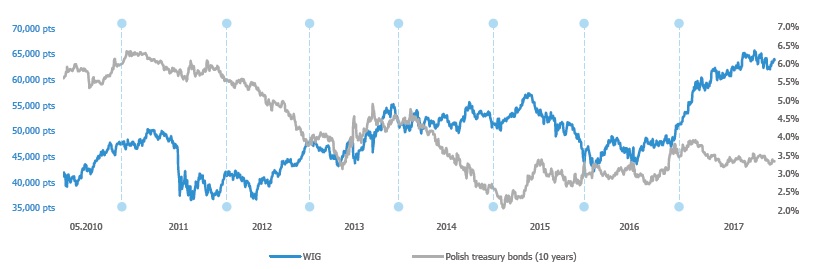

WIG / Treasury bonds

Source: www.stooq.pl, www.gpwinfostrefa.pl

In 2017, Poland was among the top beneficiaries of the growing confidence in emerging markets.

WIG20 ranked in the top five fastest-growing European stock market indices. The growth in the valuations of Polish companies was supported by improving economic indicators, including the high rate of economic growth, current account balance, a very low deficit of the state budget (the lowest since 2007-08 in annual terms), increasing wages and the rate of employment, and appreciation of the Polish currency (in 2017, the exchange rate of the U.S. dollar expressed in the Polish zloty declined by 16.8% y/y to approx. PLN 3.48, and the exchange rate of the euro fell by 5.2% y/y to PLN 4.18).

The situation on the Polish debt market was undisturbed by the interest rate hikes, reduced values of central banks’ balance sheets, improving macroeconomic indicators or growing appetite for risky asset classes. In H1 2017, yields on 10-year treasury bonds dwindled from 3.9% to 3.2%, and then oscillated between 3.2% and 3.5% in the second half of the year.

Yields on 2-year treasury bonds declined by 32 bps in 2017 to 1.71%, whereas yields on 5-year and 10-year T-bonds decreased by 24 bps and 33 bps, respectively, ending the year at 2.65% and 3.30%. Read more