PZU’s investor relations

Equities and Bonds

Meeting stringent information governance requirements for public companies and fulfilling information needs of different groups of stakeholders, the Management Board of PZU undertakes various investor relations activities aimed at improving transparency in the company and procuring equal access to information. Therefore, PZU has consistently applied the “Principles for PZU to Conduct its Information Policy for Capital Market Participants”.

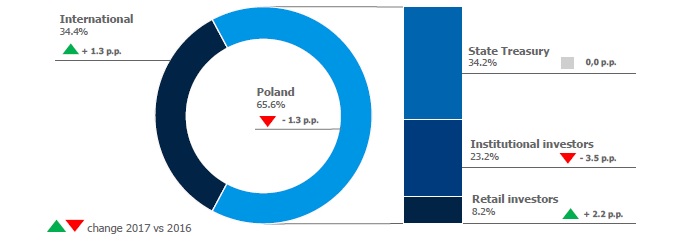

PZU shareholder structure

As at 31 December 2017, the only shareholder with a stake in PZU greater than 5% was the State Treasury of the Republic of Poland (34.2% of the share capital) SECTION 9.6 PZU’S SHARE CAPITAL AND SHAREHOLDERS.

According to a survey carried out at the end of 2017, PZU’s shareholder structure remained stable and diversified, with a slight increase in the share of foreign investors (+1.3 p.p.).

In the structure of Polish investors, a significant change took place in the share of retail investors, which increased by 2.2 p.p. up to 8.2% (70.8 million shares). It was a record high comparable to that of PZU’s IPO at which retail investors subscribed for more than 70 million shares. This structural change largely reflected the general trend on the WSE. In H1 2017, the share of retail investors in trading on the regulated market increased to 18% (+5 p.p.), the highest level in 5 years. The share of foreign individual investors remained unchanged compared to 2016 and stood at 1.1%.

PZU shareholder structure - main investor groups

Source: IPREO

As at the end of 2017, the share of Polish institutional investors declined by 3.5 p.p., partly caused by a reduction in exposures of open-end pension funds and mutual fund companies. As at the end of 2017, their shares were 18.0% (-1.1 p.p.) and 4.4% (-0.9 p.p.), respectively.

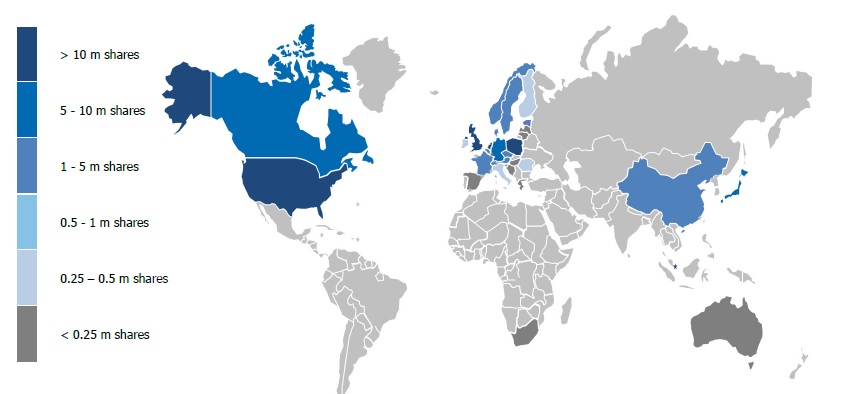

Geographical structure of PZU’s shareholders

Source: IPREO

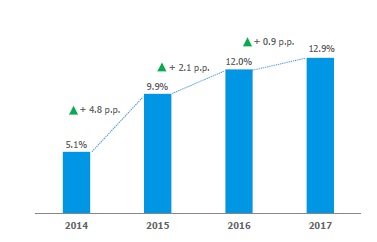

North American investors 2014-2017

2017 marked another year in a row with an increase in the share of foreign investors in the PZU shareholder structure (+1.3 p.p. in 2017 compared to +1.2 p.p. in 2016). The change in this group of investors was mainly due to capital inflows from North America whose share increased by 0.9 p.p. y/y and stood at 12.9%. A structural change also occurred in this subgroup where investors from the United States strengthened their dominance, accounting for 94.5% of all investors as at the end of the year (+2.5% y/y).

As regards European institutional shareholders (excluding the State Treasury of the Republic of Poland), a further increase (+1.1 p.p.) was recorded in UK-based investors whose share as at the end of 2017 was 22.0%. Exposure of investors from the Netherlands also increased: by approx. 2.1 p.p. to 3.5%.

Communication with capital market players

In 2017, PZU broadcasted all key corporate events live, namely:

- PZU Group’s financial results (for 2016, Q1 2017, H1 2017 and Q1-3 2017);

- Ordinary Shareholder Meeting;

- two Extraordinary Shareholder Meetings;

- announcement by PZU and PFR of finalization of the transaction to purchase a 32.8% stake in Bank Pekao SA.

In 2017, PZU once again presented its key events, achievements and plans in the form of an online Annual Report at http://raportroczny2016.PZU.pl/. Users were provided with tools that enabled a multi-faceted analysis of corporate and macroeconomic events. The report includes interactive infographics, animations and video materials, which offer a succinct presentation of PZU Group’s activity in 2016.

Activities addressed to institutional investors

In 2017, PZU representatives participated in the following:

- 3 non-deal roadshows in New York, London and Edinburgh (2 in 2016);

- 12 international finance conferences attended by global institutional investors (15 in 2016);

- 4 conferences for institutional investors held in Warsaw (5 in 2016);

- numerous investor meetings at the company’s headquarters: one-on-one, group meetings and conference calls.

During which 161 meetings with 368 managers were held.

Additionally, in 2017 PZU actively met with investors and analysts at the company’s headquarters. Approximately 80 meetings and conference calls were held with more than 200 institutional investors and nearly 100 meetings and conference calls with analysts issuing recommendations concerning PZU’s shares.

Investment centers visited in 2017 (number of visits)

Activities addressed to retail investors

In 2017, PZU engaged in active dialogue with retail investors, in particular by providing reliable and up-to-date information on the activities of PZU, the insurance industry and financial markets. In this respect, PZU implemented both communication projects (e.g. the online report, a newsletter, a factsheet) and took active steps to enable direct contact between investors and the Company’s representatives, including, among others:

- for the seventh time, it participated in the largest conference for individual investors organized in Poland by the Association of Individual Investors: the 21st WallStreet Conference in Karpacz, which is the largest meeting of individual investors in Central and Eastern Europe;

- organized four chats with individual investors hosted by a Member of the PZU Management Board in charge of the PZU Group’s Finance Division each time after publication of quarterly financial results

Without interruption since 2012, PZU has also been participating in a program conducted by the Association of Individual Investors called “10 of 10: Communicate Effectively) whose purpose is to develop high communication standards between public companies and retail investors.

Prizes and distinctions for IR activities

PZU’s investor relations activities are highly regarded by investors, analysts and the media. In 2017, PZU received the following prizes and distinctions in this area:

- award for the highest usefulness of an annual report among banks and financial institutions in the Best Annual Report contest organized by the Institute of Accounting and Taxes (Instytut Rachunkowości i Podatków).

- third place for Tomasz Kulik in the ranking of the best CFOs for investor relations in Poland and Central and Eastern Europe in the Extel 2017 survey;

- third place for the Investor Relations team in the ranking of the best investor relations in Poland in the Extel 2017 survey.

IR objectives in 2018

The main objectives of PZU’s investor relations function in 2018:

- strengthen good relations between the PZU Management Board and the community of investors;

- ensure understanding and approval for PZU’s business strategy among investors and analysts;

- secure a deep and broad market for PZU’s shares and bonds by continuing investor-friendly measures to build a diversified base (in terms of geography, numbers and profile) of an appropriate number of well-informed investors familiar with the company;

- ensure broad coverage for PZU shares by sell-side analysts of investment banks and brokerage houses and accurate valuation of PZU shares by providing analysts with high quality information about PZU’s operations, industry trends, drivers of financial performance and feedback after analysis of their recommendations;

- setting standards in investor relations that may serve as an example to be followed by other public companies;

- provide the PZU Management Board with regular feedback concerning the perception of PZU among capital market players and broad knowledge of current and potential shareholders of the company;

- monitor investor sentiment towards PZU shares and changes in the shareholder structure in order to adopt the most adequate investor relations measures and tools;

- introduce standards of PZU Group’s non-financial reporting.