PZU Group’s income

Premiums

In 2017, the PZU Group collected gross premiums of PLN 22,847 million or 13.0% more than in 2016.The individual segments recorded the following figures:

- sales in the mass client segment higher by PLN 1,287 million (net of intersegment gross written premium) compared to 2016, chiefly including motor insurance due to an increase in average premium and the quantity of policies;

- premium increased in the corporate client segment by PLN 537 million from 2016 (net of intersegment gross written premium), mainly in motor insurance due to the higher average premium and number of insurance policies, insurance against fire and other damage to property following the execution of several contracts with high unit values;

- sales increased by PLN 80 million in the group and individually continued insurance segment – the additional premium was received from health insurance concluded as group insurance;

- the premium in the individual insurance segment also rose by PLN 490 million, driven mainly by higher sales of unit- linked products in the bancassurance channel;

- gross premium written by foreign companies also increased as compared to 2016 by PLN 234 million, chiefly in motor insurance, driven by higher tariffs in the Baltic States.

Net revenues from commissions and fees

Net revenues from commissions and fees in 2017 contributed PLN 1,784 million to the PZU Group’s result, or were PLN 1,240 million higher than in the previous year, mainly caused by the commencement of Pekao’s consolidation.

They included mainly:

- net revenues from commissions and fees in the banking segment of PLN 1,605 million, including mainly: brokers’ commissions, revenues and expenses related to the service of bank accounts, payment and credit cards, fees charged for intermediation in insurance sales;

- income on asset management in OFE Złota Jesień. It was PLN 120 million (up 29.0% compared to the previous year, because of the higher average net assets of OFE PZU);

- revenues and fees received from funds and mutual fund companies in the amount of PLN 277 million, or PLN 166 million more than in the previous year, mainly caused by the commencement of Bank Pekao’s consolidation.

Insurance segments (PLN millions), local GAAP

| Insurance segments (PLN millions), local GAAP | Gross written premium (external) | ||||

| 2017 | 2016 | 2015 | 2014 | 2013 | |

| TOTAL | 22 847 | 20 219 | 18 359 | 16 885 | 16 480 |

| Total non-life insurance – Poland (external gross written premium) | 12 702 | 10 878 | 9 074 | 8 367 | 8 269 |

| Mass insurance – Poland | 10 029 | 8 742 | 7 309 | 6 560 | 6 534 |

| Motor TPL | 4 606 | 3 635 | 2 594 | 2 373 | 2 453 |

| Motor own damage | 2 406 | 2 147 | 1 728 | 1 579 | 1 549 |

| Other products | 3 017 | 2 960 | 2 987 | 2 608 | 2 531 |

| Corporate insurance – Poland | 2 673 | 2 136 | 1 765 | 1 807 | 1 735 |

| Motor TPL | 735 | 532 | 368 | 354 | 372 |

| Motor own damage | 848 | 712 | 509 | 461 | 479 |

| Other products | 1 090 | 892 | 888 | 992 | 885 |

| Total life insurance – Poland | 8 519 | 7 949 | 7 923 | 7 808 | 7 745 |

| Group and individually continued insurance – Poland | 6 855 | 6 775 | 6 689 | 6 539 | 6 415 |

| Individual insurance – Poland | 1 664 | 1 174 | 1 234 | 1 269 | 1 330 |

| Total non-life insurance – Ukraine and Baltic States | 1 527 | 1 304 | 1 288 | 632 | 388 |

| Ukraine non-life insurance | 181 | 173 | 138 | 133 | 157 |

| Baltic States non-life insurance | 1 346 | 1 131 | 1 151 | 499 | 230 |

| Total life insurance – Ukraine and Baltic States | 100 | 88 | 74 | 78 | 78 |

| Ukraine life insurance | 42 | 37 | 31 | 41 | 47 |

| Baltic States life insurance | 58 | 51 | 43 | 37 | 32 |

Structure of gross written premium at PZU Group (%)

Net investment result and interest expenses

In 2017, the PZU Group’s investment activity focused on the continuation of strategic assumptions, in particular on the optimization of profitability of investment operations through greater diversification of the investment portfolio, as well as ensuring financing for the transaction of PZU’s acquisition of an equity stake in Bank Pekao.

In 2017, the PZU Group’s net investment result was PLN 8,502 million compared to PLN 3,511 million in 2016 (up 142.2%). This higher result was caused largely by the commencement of Pekao’s consolidation.

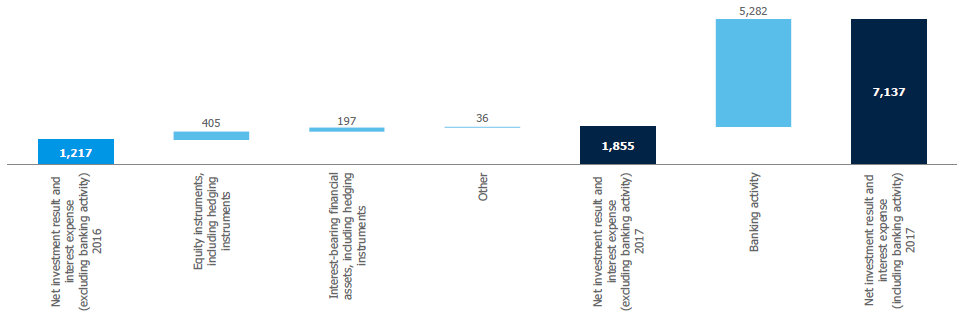

The net investment result (after factoring in interest expenses and precluding the impact exerted by banking activity) in 2017 was PLN 1,855 million. It was higher than last year’s result by PLN 638 million, which was primarily due to the following drivers:

- higher result earned on listed equity instruments in particular due to improved market conditions on the Warsaw Stock Exchange – the WIG index went up 23.2% in 2017 compared to 11.4% the year before, including a better performance of the stake in the Azoty Group;

- better performance on interest-bearing financial instruments driven chiefly by:

- better performance of non-treasury debt market instruments due to the acquisition of high-margin exposures for the portfolio,

- decreases in the yields on Polish T-bonds,

- purchase of high-yield government bonds on the primary market for PLN 2 billion for the held-to-maturity bond portfolio,

- positive impact exerted by the foreign exchange differences on own debt securities in conjunction with the appreciation of the PLN versus EUR following depreciation in the comparable period, partially offset by weaker performance of investments denominated in EUR;

- decrease in the valuation of real properties, in particular due to the appreciation of PLN against the euro, partially offset by better performance of derivatives hedging these positions;

- performance in the portfolio of assets to cover investment products up PLN 174 million y/y, including in particular funds in the unit-linked portfolio, even though it does not affect the PZU Group’s total result.

Movement in net investment result after factoring in interest expenses and factoring out the impact of banking operations (PLN million)

As at the end of 2017, the value of the PZU Group’s investment portfolio, excluding the impact of banking activity, was PLN 46,164 million compared to PLN 50,488 million as at the end of 2016. The drop in the balance of deposits was driven in particular by the funding of PZU’s acquisition of the equity stake in Bank Pekao.

The Group runs its investment operations in compliance with statutory requirements while maintaining appropriate levels of safety, liquidity and profitability. Debt treasury securities accounted for over 60% of the investment portfolio, net of the impact of banking activity, both as at 31 December 2017 and 31 December 2016. The increase in the volume of non-treasury debt market instruments resulted from the persistently implemented investment policy aimed at achieving a greater diversification of the investment portfolio. The lower level of monetary market instruments is associated with funding the acquisition of the equity stake in Pekao.

Result on other operating income and expenses

In 2017, the balance of other operating income and expenses was negative and stood at PLN 1,559 million, compared to the balance in 2016, which was also negative at a level of PLN 724 million. The following contributed to this result:

- levy on financial institutions – the PZU Group’s liability on account of this levy (in both insurance and banking activity) in 2017 was PLN 822 million compared to PLN 395 million in the corresponding period of the previous year. The increase in the liability was caused by the commencement of Pekao’s consolidation in June 2017 and the introduction of the tax in February of last year;

- costs of amortization of intangible assets identified as a result of the acquisition transaction up by PLN 188 million (effect of the acquisition of the equity stake in Pekao);

- lower level of other operating income associated with last year’s recognition of a gain on the bargain acquisition of a spun-off portion of BPH in the amount of PLN 465 million;

- recognition in 2016 of the cost of the restructuring provision associated with the merger of Alior Bank with the spun-off portion of BPH in the amount of PLN 268 million.

1 The investment portfolio includes financial assets (including investment products net of loan receivables from clients), investment property (including the portion

presented in the class of assets held for sale), the negative measurement of derivatives and liabilities under sell-buy-back transactions.

Structure of the portfolio of investments net of the impact of banking activity* (%)

* Derivatives linked to interest rates, foreign currencies and securities prices, respectively are presented in the categories: Debt market instruments - treasury, money market instruments and listed and unlisted equity instruments.