Non-life insurance (PZU, LINK4 and TUW PZUW)

Business

Market situation

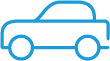

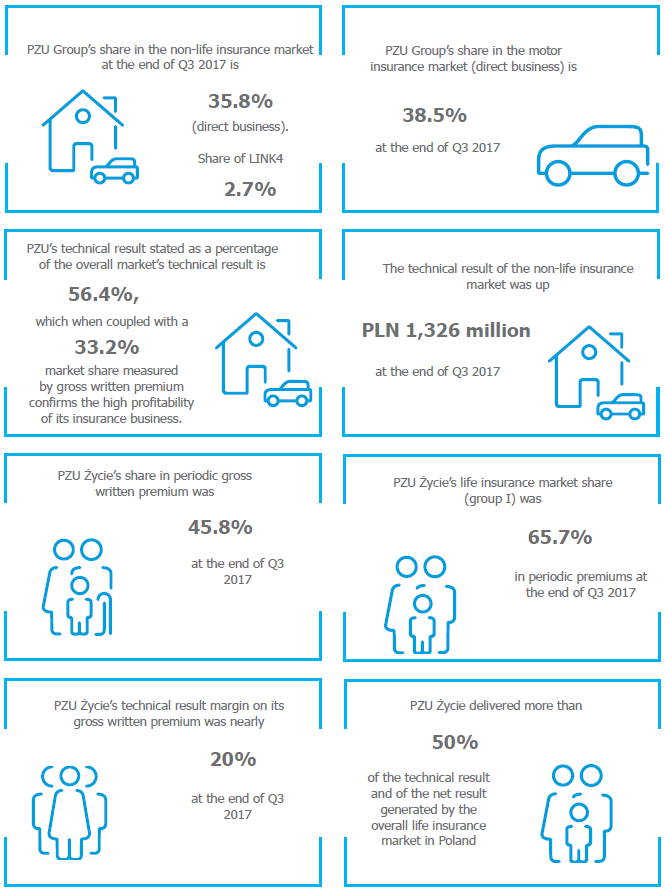

Measured by gross written premium in the first three quarters of 2017, the non-life insurance market in Poland grew by a total of PLN 4,718 million (+20.4%) in comparison to the corresponding period of the previous year.

Gross written premium of non-life insurance undertakings in Poland (PLN million)

The sales growth in motor TPL insurance (up PLN 3,174 million, +37.1%) and motor own damage insurance (up PLN 811 million, +16.8%) made the largest contribution to the higher level of premium, chiefly as the outcome of the significantly higher average premium (the consequence of the price hikes rolled out in 2016 as a response to the persistently negative results on the motor insurance market) and the climbing percentage of premium originating from indirect activity (motor TPL insurance up PLN 332 million year on year).

In addition, higher sales of insurance against fire and other physical losses (up PLN 353 million, +7.7%, of which PLN 22 million pertains to indirect activity) and accident and sickness insurance (up PLN 127 million, 7.9%) made a positive contribution to the overall non-life insurance market’s growth, chiefly as a consequence of the upswing in the growth rate of motor insurance premiums.

It should be pointed out that, as a result of the transfer of the business of Liberty Seguros Compania de Seguros y Reaseguros S.A. Poland Branch and the insurance portfolio of Avanssur S.A. Poland Branch to AXA Ubezpieczenia TUiR S.A., the whole market grew, partly as a result of the inclusion of the premium generated by Liberty Seguros Compania de Seguros y Reaseguros S.A. Poland Branch to reporting to KNF. Branches of insurance undertakings registered in other EU countries are not required to report their financials to KNF.

Non-life insurance undertakings - percentage of gross written premium in Q1 - Q3 2017 (%)

In the first three quarters of 2017, the overall non-life insurance market generated a net result of PLN 2,984 million, signifying incremental growth of PLN 1,758 million in comparison with the corresponding period of 2016. Excluding the dividend from PZU Życie, net profit of the non-life insurance market increased PLN 1,154 million (287.8%).

In the first 3 quarters of 2017, the technical result of the non-life insurance market rose PLN 1,326 million to PLN 1,507 million. The growth in the technical result in motor TPL insurance of PLN 1,153 million, in the class of motor own damage insurance of PLN 296 million and assistance services of PLN 31 million made the largest contribution to this change.

The spike in the technical result in the class of motor TPL insurance chiefly ensues from the higher earned premium (up PLN 2,530 million, +43.2%) on the back of the changes made last year to the average premium forming a response to the market’s deteriorating results, outpacing growth in claims paid (up PLN 1,089 million, +20.5%).

The largest decrease in technical result was recorded in the class of insurance against fire and other damage to property (down PLN 122 million) and general third party liability insurance (down PLN 65 million) as a result of a slower growth in net earned premium (up PLN 112 million or +2.4%) compared to the rate of growth in claims and benefits (up PLN 314 million or +13.4%), which was largely a consequence of many losses caused by the forces of nature in August (hurricane Xavier) and December (hurricane Grzegorz) 2017.

Non-life insurance market - gross written premium vs. technical result (in PLN million)

| Gross written premium vs. technical result | 1 January - 30 September 2017 | 1 January - 30 September 2016 | ||||

|---|---|---|---|---|---|---|

| PZU* | Market | Market net of PZU | PZU | Market | Market net of PZU | |

| Gross written premium | 10 264 | 27 854 | 17 590 | 8 230 | 23 136 | 14 905 |

| Technical result | 853 | 1 507 | 654 | 308 | 181 | -126 |

* it contains LINK4 and TUW PZUW

Source: KNF (www.knf.gov.pl). Quarterly Bulletin. Rynek ubezpieczeń [Insurance market] 3/2017, Rynek ubezpieczeń 3/2016, PZU’s data

The following entities in the PZU Group operate on the non-life insurance market in Poland: the Group’s parent company, i.e. PZU and LINK4; the Polish Mutual Insurance Undertaking (TUW PZUW) joined them in November 2015.

To respond to client expectations in recent years, the PZU Group has extended its offering for retail and corporate clients (by forming a mutual insurer), thereby steadily growing its market share.

After the first three quarters of 2017, the PZU Group had a 36.8% share in the non-life insurance market, compared to 35.6% after the first three quarters of 2016 (35.8% and 35.4% from direct business, respectively), thus recording growth, despite significant changes in the structure of the non- life insurance market affecting the year-on-year comparability of premium levels (including the transfer, in October 2016, of the business of Liberty Seguros Compania de Seguros y Reaseguros S.A. Poland Branch and the insurance portfolio of Avanssur S.A. Poland Branch to AXA Ubezpieczenia TUiR S.A.).

After the first three quarters of 2017, the PZU Group’s technical result (PZU together with LINK4 and TUW PZUW) stated as a percentage of the overall market’s technical result was 56.6% (the PZU Group’s technical result was PLN 853 million while the overall market’s technical result was PLN 1,507 million), illustrating its insurance portfolio’s high level of profitability.

The total value of the investments made by non-life insurance undertakings at the end of Q3 2017 (net of the investments made by subordinated entities) was PLN 52,623 million, up 1.9% compared to the end of 2016.

The non-life insurance undertakings in total estimated their net technical provisions at PLN 47,850 million, signifying 7.3% growth compared to the end of 2016.

PZU’s activity

As the PZU Group’s parent company, PZU offers an extensive array of non-life insurance products, including motor insurance, property insurance, casualty insurance, agricultural insurance and third party liability insurance. At yearend 2017, motor insurance was the most important group of products offered by PZU, both in terms of the number of insurance agreements and its premium stated as a percentage of total gross written premium.

Against the background of changing market conditions, in 2017 PZU aligned its offering with clients’ new interests and needs by rolling out new solutions and products, often with a touch of innovation. In mass insurance, PZU did the following:

- extended its offering to include health insurance products to supplement PZU Auto, PZU Dom and Wojażer travel insurance policies. Depending on the selected option, the client receives a bundle of health benefits in the event of an accident or sudden illness in the form of access to private medical care, including medical consultations, diagnostics and rehabilitation along with advice from a Medical Assistant who will help in planning a specific course of treatment. This offering stands out among its counterparts available on the market due to an efficient organization of the treatment and rehabilitation processes with a guarantee of accessibility owing to the broad network of medical centers, including PZU Zdrowie’s own centers;

- introduced a new partnership option in its motor own damage PZU Auto insurance, having properly identified clients’ expectations in a market of changing motor insurance prices. Despite a lower premium, this option offers full insurance coverage and a high quality repairs in one of PZU’s partner workshops. Along with this option, the possibility of a lump-sum deductible (of PLN 500) has been introduced, significantly lowering the premium. The deductible is fixed and invariable regardless of the value of the loss. The selection of options available in the offering (Optimal, Maintenance and Repair, Partner) along with the application of a deductible provides the opportunity to mold the premium and protection by aligning the insurance with the client’s current needs and price-sensitivity without having to forgo motor own damage insurance;

- supplemented the bundle of PZU Dom’s residential insurance with a new type of insurance, namely Remote Assistance by an IT Specialist, providing assistance to clients experiencing problems with their computers. In such a situation, the client, over the Internet or using a dedicated application, obtains support from an IT specialist who remotely connects to the client’s computer to remove the software defect that prevents its trouble-free use;

- extended its offering of agricultural insurance, including the coverage of movable property in farms by introducing an “all risk” agricultural clause and insurance of structures located on the farm;

- introduced, as the only insurer in Poland, an innovative method of verifying whether a vehicle had been seriously damaged in the past, to an extent rendering its repair economically unjustified or carrying the risk that the damaged vehicle will not be restored to a condition ensuring its safe use. In the process of offering motor own damage insurance, the Everest system will verify online if the vehicle has been entered in the database of over 11 million wrecked automobiles offered for sale in Europe and if the vehicle is found in this database, then the terms of insurance will be established by way of case-specific underwriting;

- deployed a pilot program called PZU Drive as a forerunner of the new offering dubbed PZU GO to be available starting from spring 2018. This was the first step toward adopting solutions on the Polish market that are popular on certain foreign markets and which are rooted in the use of mobile technologies enabling the determination of the premium based on the profile of a specific driver. For the purposes of the pilot deployment, an application was developed which, when installed on a smartphone and used regularly, provides telematic data enabling the provision of information about various driving styles that in practice affect the insurer’s exposure to risk. PZU is hopeful that this solution will enable it to lower the premiums charged to “safe” drivers and popularize the Pay How You Drive (PHYD) solution in Poland.

Most changes in the corporate insurance segment were associated with the regular launch of products dedicated to corporate clients administered and sold in the Everest system, with the offering extended by insurance against cyber threats. The new insurance offers protection against the adverse effects of hacking attacks, including by taking actions aimed at destroying the attack and restoring the company’s normal operations. This offering is targeted especially at those clients who are at risk of data leakage or operational paralysis caused by a cyber-attack. This insurance provides cover for the costs of extortion, image repair, expert reports and investigative actions.

In the domain of financial insurance, PZU was unswerving in its support for the Polish economy by providing insurance guarantees and securing the performance of contracts in such key areas of the economy as the power sector, the shipbuilding industry, the construction industry and the science and innovation sector. At the same time, reaching out to clients and their expectations, PZU deployed new financial insurance products, such as:

- GAP insurance for financial losses targeted at lessees and borrowers signing agreements with banks or leasing companies. This insurance is against the risk of financial losses caused as a result of a total loss of the lessee’s or borrower’s vehicle covered by the insurance policy as part of a motor own damage insurance product or under the perpetrator’s third party liability insurance;

- Mortgage loan repayment insurance tied to a decrease in the value of the real estate caused by a random event.

In 2017, PZU cooperated with 10 banks and 8 strategic partners. PZU’s business partners are leaders in their industries and they have client bases with enormous potential offering an opportunity to extend the offering to include more products, often based on innovative solutions. In 2017, PZU established cooperation with the PZU Group’s member banks, namely Alior Bank S.A. and Pekao S.A., launching the roll-out of a comprehensive offering via its distribution network. PZU’s cooperation with Pekao S.A. and Alior Bank S.A. will enable the Company to offer its clients an extensive array of both financial and insurance services at each stage of their lives. In strategic partnerships, cooperation applied mostly to companies operating in the telecom and power sectors through which insurance for electronic equipment and assistance services were offered, e.g. the assistance of an electrician or a plumber.

LINK4’s activity

LINK4, which entered the Polish market 15 years ago as the first undertaking offering direct insurance products, still remains one of the leaders on the direct insurance market. It offers an extensive range of non-life insurance products, including motor insurance, property insurance, personal insurance and third party liability insurance.

In 2017, the company was focused predominantly on the development of new technologies and innovations, both in terms of products and processes, which turned LINK4 also into a perceived leader in the area of innovations.

The most important activities associated with modifying its product offering in 2017 were as follows:

- a telematic program called LINK4 Kasa Wraca [LINK4 Cash Back] deployed in cooperation with NaviExpert, aimed at promoting and rewarding a safe driving style. By applying such a style, LINK4’s clients may have part of their premium, up to 30 percent of it, refunded. As of 26 April, LINK4 offers navigation with this application free of charge along with every TPL insurance or package. It uses telematic solutions to assess a driver’s driving style;

- a short transportation calculator on mobile devices deployed in mid-2017 and a chat bot introduced as a new functionality in these communication channels;

- launching innovative products offering among others insurance for household pets and ADD insurance along with insurance in the event of complications following tick bites or other insect bites;

- completion of roll-out work on LINK4Mama [LINK4Mom] and LINK4Dziecko [LINK4Child] bundles addressing specific risks related to consequences of accidents and third party liability – insurance offered in cooperation with PZU Zdrowie;

- launch of sales of travel insurance through an insurance policy vending machine which is currently the most innovative channel for sales of insurance policies – the insurance policy vending machine at the Modlin airport near Warsaw offers two insurance options, namely a recommended option and a flexible option enabling the client to tailor the product to his or her specific needs;

- in Q4 2017, enriching the residential insurance offering with smoke detectors proposed for each policy with a premium greater than PLN 210.

TUW PZUW’s activity

Towarzystwo Ubezpieczeń Wzajemnych Polski Zakład Ubezpieczeń Wzajemnych [Polish Mutual Insurance Company] (TUW PZUW) has been actively operating on the insurance market since 29 February 2016 when it launched underwriting operations by selling its first policy.

TUW PZUW offers its clients a flexible insurance program to optimize the costs and scope of cover. Since 2016, it has been selling and handling insurance products targeted at clients from various industries, focusing predominantly on cooperation with large enterprises, medical centers (hospitals and clinics) and local government units. Such entities, within the framework of cooperation exercised under TUW’s model, are provided with the opportunity to dissipate their risks within the boundaries of mutual benefit societies adjusted to the specific nature of the pertinent group of entities and thereby reducing the costs of their insurance premiums. TUW has 182 members for whom 36 mutual benefit societies have been established.

In 2017, the primary emphasis was placed on organizational development, expansion of the team of professionals offering better insurance service to the mutual’s members and aligning its offering to its clients’ needs.

The most important activities associated with modifying its product offering in 2017 were as follows:

- jointly marketing with PGE Obrót a new product called “Health of PGE Energy” offering a guaranteed fixed price for energy coupled with an assistance service such as that from an electrician;

- crafting new general terms and conditions of insurance, including directors and officers insurance (D&O);

- extending the offer to include products focusing on another pillar: local governments.

Factors, including threats and risks that will affect the operations of the non-life insurance sector in 2018

Besides chance events (such as floods, droughts and spring ground frost), the following should be treated as the main factors that may affect the situation of the non-life insurance sector in 2018:

- possible slowdown in economic growth in Poland. A poorer financial standing of companies may result in elevated credit risk and a higher loss ratio on the financial insurance portfolio;

- case law regarding the amount of financial compensation for moral damages under TPL insurance held by owners of motor vehicles to the deceased’s closest family members for the suffered injury (art. 446 of the Civil Code);

- increase in claims handling costs due to the implementation of VAT on motor claims handling services rendered in favor of insurance companies and their intermediaries;

- increase in the prices of spare parts affecting claims handling costs due to the depreciation of the Polish zloty against the euro;

- adjustment of insurance undertakings to the EU General Data Protection Regulation, i.e. the GDPR – Read more;

- emergence of more regulations or financial burdens on insurance undertakings – among others, the possible reinstatement of the “Religa tax” (mandatory fee paid to the National Health Service on every TPL motor insurance policy).