Contribution made by the market segments to the consolidated result

The following industry segments were identified in order to facilitate management of the PZU Group:

- corporate insurance (non-life insurance) – this segment covers a broad scope of property insurance products, liability and motor insurance customized to a client’s needs entailing individual underwriting offered by PZU, TUW PZUW to large businesses;

- mass insurance (non-life insurance) – this segment consists of property, accident, liability and motor insurance products. PZU and LINK4 provide insurance to individuals and entities from the SME sector;

- life insurance: group and individually insurance – PZU Życie offers it to employee groups and other formal groups. Persons under a legal relationship with the policyholder (e.g. employer, trade union) enroll in the insurance agreement and individually continued insurance in which the policyholder acquired the right to individual continuation during the group phase. It includes the following insurance types: protection, investment (which however are not investment contracts) and health insurance;

- individual life insurance – PZU Życie provides those products to retail clients. The insurance agreement applies to a specific insured who is subject to individual underwriting. These products include protection, investment (which are not investment contracts) and health insurance;

- investments – reporting according to Polish GAAP – the revenues of the investments segment comprise the investments of the PZU Group’s own funds, understood as the surplus of investments over technical provisions in the PZU Group insurance companies based in Poland (PZU, LINK4 and PZU Życie) plus the surplus of income earned over the risk-free rate on investments reflecting the value of technical provisions of PZU, LINK4 and PZU Życie in insurance products, i.e. the surplus of investment income of PZU, LINK4 and PZU Życie over the income allocated at transfer prices to insurance segments. Additionally, the investment segment includes income from other free funds in the PZU Group (including consolidated mutual funds).

- Banking segment – a broad range of banking products offered both to corporate and retail clients by Pekao and Alior Bank.

- Baltic States segment – includes non-life insurance and life insurance products provided in the territories of Lithuania, Latvia and Estonia;

- investment contracts – include PZU Życie products that do not transfer material insurance risk and do not satisfy the definition of insurance contract. They include some products with a guaranteed rate of return and some products in the form of a unit-linked insurance product;

- other – include consolidated companies that are not classified in any of the above segments.

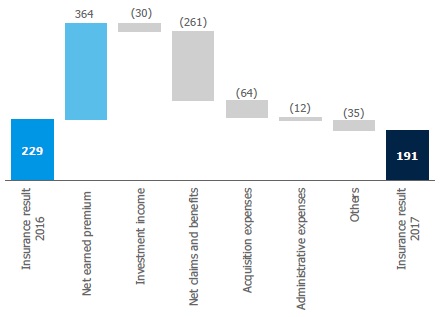

Corporate insurance

The corporate insurance segment (consisting of PZU and TUW PZUW) generated an insurance profit of PLN 191 million in 2017, i.e. 16.6% less than in the corresponding period of the previous year.

The following factors had a key impact on this segment’s performance in 2017:

- a 22.2% increase in net earned premium combined with a 25.9% increase in gross written premium, both in comparison to 2016. The following movements were observed in sales:

- higher premiums from motor insurance, both fleet- based and offered to leasing companies, as a result of an increase in the average premium and the number of insurance policies;

- sales growth in fire insurance and other property claims and other TPL insurance as the offshoot of signing several high unit value agreements, including enrollment of two large entities from the coal and power industries in TUW PZUW;

- development of the assistance and accident insurance portfolio as a result of expanding cooperation with strategic partners;

- net claims and benefits surged 24.6% compared to the corresponding period of 2016, which, together with a 22.2% increase in net earned premium, means that the loss ratio increase by 1.3 p.p. to 66.0%. The higher loss ratio in the class of insurance against losses caused by the forces of nature and TPL was attributable largely to numerous damages caused by the forces of nature in August (Hurricane Xavier) and December (Hurricane Greg) and the reporting of several large claims. This effect was partly offset by the improved profitability of the motor insurance portfolio.

- income from investments allocated to this segment fell 26.1% to PLN 85 million, which was caused in particular by the declining EUR exchange rate vs. PLN;

- the PLN 64 million, or 17.7%, upswing in acquisition expenses (net of reinsurance fees) compared to 2016 stemming primarily from the considerably higher sales growth rate (+25.9%);

- growth in administrative expenses to PLN 137 million, or 9.6%, compared with the previous year. Higher expenses were recorded mainly in the IT and third party services, which was related to implementing products dedicated to corporate clients to be administered and sold in the Everest system. This effect was partially offset by a decline in project-related expenses.

Insurance result in the corporate insurance segment (PLN million)

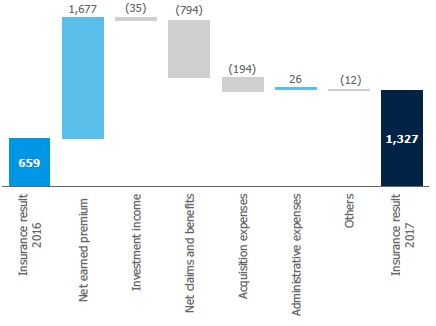

Mass insurance

In 2017, the net result of the mass insurance segment was PLN 1,327 million, almost twice as much as in 2016 (+101.4%). The following factors drove this segment’s performance in 2017:

- a 21.4% increase in net earned premium to PLN 9,513 million combined with a PLN 1,235 million (+14.0% y/y) rise in gross written premium in comparison to 2016, driven by a combination of the following:

- rising motor insurance sales (+21.1%) as an effect of the gradually introduced in 2016 increases in the average premium on the coattails of price hikes forming a response to deteriorating results of the whole market in Poland in recent years;

- higher premium from insurance against fire and other damage to property (+14.3% of gross written premium y/y), including PZU DOM household insurance and agricultural insurance despite the extensive competition on the market (chiefly subsidized crop insurance), and

- lower premium in the group of accident and other insurance, in particular various financial risks as a consequence of the termination of cooperation with a large strategic partner.

- higher net insurance claims and benefits in 2017 by 15.1%, which when coupled with net earned premium being up 21.4%, translated into the loss ratio improving by 3.5 percentage points

- compared to 2016. This change resulted mainly from:

- the lower level of claims in the group of insurance for other damage to property, mostly for subsidized crop insurance – in the corresponding period of 2016 there were many losses caused by frost and winterkill;

- the improving profitability of the motor insurance portfolio, in particular Motor TPL insurance, following the changes introduced in the tariff. This effect was partially offset by the observed growth in the average claim;

- decrease in the profitability of insurance against damage caused by the forces of nature and general third party liability insurance, which was largely a consequence of the losses caused by the August and December 2017 hurricanes;

- income from investments allocated to the mass insurance segment according to transfer prices amounted to PLN 482 million, down 6.8% year on year, which was caused in particular by the declining EUR exchange rate vs. PLN;

- acquisition expenses reached PLN 1,745 million, rising by 12.5% as compared to 2016, mainly due to the higher direct acquisition expense (also on the coattails of the growing insurance portfolio). The additional factor that had a positive effect on acquisition expenses was the fact that, according to the requirements of the Insurance Activity Act, the rules for paying consideration to policyholders in group contracts were altered – as of 1 April 2016, these expenses are treated as administrative expenses.

- administrative expenses in this segment amounted to PLN 608 million, down by PLN 26 million, or 4.1% less, than the year before, driven primarily by the cost discipline both in current activity and in project activity.

Insurance result in the mass insurance segment (PLN million)

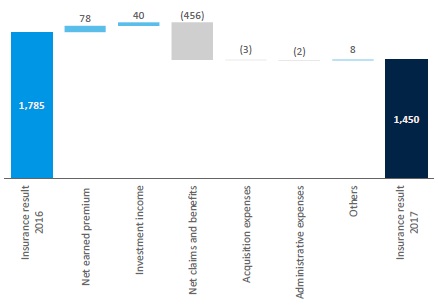

Group and individually continued insurance

Insurance result in the group and individually continued insurance amounted to PLN 1,450 million and was PLN 335 million, or 18.8%, lower than in the previous year. Individual constituent elements of the insurance result were as follows.

Gross written premium was higher than in the corresponding period of the previous year by PLN 80 million (1.2%), which was mainly the result of the following:

- attracting more premium income in group health insurance products or individually continued products (new clients in outpatient insurance and sales of different options of the medicine product);

- growth in group protection insurance (higher average premium and average number of riders taken out by each insured);

- active up-selling of riders in individually continued products, including, in particular, along with offering basic agreements in PZU branches, and raising sums insured during the term of the existing agreements.

The investment result consists of income allocated using transfer prices and income on investment products. In the group and individually continued insurance segment, investment income rose PLN 40 million mainly due to the higher income on unit-linked products (principally employee pension schemes) as a result of better conditions on the equity market – the WIG index surged up by 23.2% compared to 11.4% in the corresponding period of last year. Income allocated by transfer prices remained at a similar level as in the comparable period of last year.

Insurance result in the group and individually continued insurance segment (PLN million)

Insurance claims and benefits and the net movement in other net technical provisions totaled PLN 5,142 million (up 9.7% y/y). This change was driven by the following factors in particular:

- in December 2016, as a consequence of the level of benefits awarded for permanent dismemberment falling in recent years, the assumptions were checked and updated for expected future payments for this purpose used to calculate provisions for this risk and this made it possible at the time to reverse 216 m PLN in provisions, mostly in continued insurance; there was no factor like that in 2017;

- higher number of deaths in Q1 2017 compared to last year and the number of claims paid for that reason in protection insurance. This uptick was justified by the higher number of deaths in the overall population of Poland at the outset of the year as the data published by the Central Statistical Office depict. In subsequent quarters the loss ratios returned to the levels observed in the corresponding periods of last year. This effect was partly offset by reversal of mathematical provisions in individually continued products after the insured’s death;

- incremental growth in the costs of benefits in health insurance as an effect of the rapid expansion of this contract portfolio;

- slightly slower pace of converting long-term insurance policies into yearly-renewable term business in type P group insurance. As a result of the conversion, in 2017 provisions were released for PLN 35 million, i.e. PLN 5 million less than in the corresponding period of 2016.

Acquisition expenses in the group and individually continued insurance segment in 2017 were PLN 332 million, increasing by PLN 3 million (0.9%) compared to the corresponding period of last year. The factor determining the increase in these expenses was the expanding portfolio of group protection and health products with a concurrent increase in the share of revenues generated in this portfolio by high-commission brokerage channels. This effect was simultaneously offset as a result of the signing of a new agency agreement in the bancassurance channel in Q2 2016 as a result of which the fee for performing agency activities involving participation in the administration of protection insurance agreements is treated as an administrative expense, unlike to the agreement previously in force that treated it as an acquisition expense.

Administrative expenses in 2017 remained at a level similar to that recorded in 2016. The PLN 2 million (0.3%) change was caused mainly by:

- the signing, in Q2 2016, of a new agency agreement in the bancassurance channel as a result of which the fee for performing agency activities involving participation in the administration of protection insurance agreements is treated as an administrative expense, unlike to the agreement previously in force that treated it as an acquisition expense, including increasing level of this sale y/y;

- this adverse factor was counterbalanced by cost cutting in project-related activities and in current activity by constantly maintaining cost discipline.

After excluding the one-off effect related to conversion of long-term contracts into renewable contracts in type P group insurance, the segment’s insurance result amounted to PLN 1,415 million in 2017, compared with PLN 1,745 million in 2016 (a 18.9% decline). As a result of excluding a non-recurring factor from the end of 2016, update of the assumptions regarding expected future disbursements on account of permanent dismemberment used in the calculation of provisions in individual continuation, the result in 2017 dropped y/y by PLN 114 million, or 7.5%, driven mainly by the increase in the number of deaths and as a consequence the number of benefits paid in Q1 for that reason compared to previous year. This uptick was justified by the higher number of deaths in the overall population of Poland at the outset of the year as the data published by the Central Statistical Office depict. In subsequent quarters the loss ratios returned to the levels observed in the corresponding periods of last year.

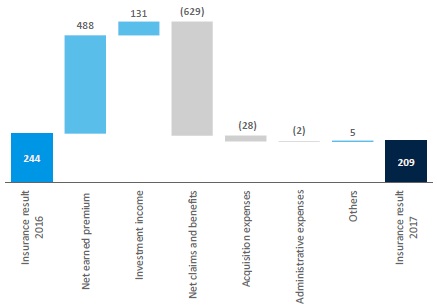

Individual insurance

In 2017, the insurance result in the individual life insurance segment was PLN 209 million, or 14.3% less than last year. The main factors affecting the segment’s insurance result are described below.

The growth in gross written premium of PLN 490 million (41.7%) to PLN 1,664 million compared to 2016 was the result of the following:

- higher contributions to the unit-linked insurance accounts offered jointly with Bank Millennium;

- sales launch of a new unit-linked product with Alior Bank at the outset of 2017;

- higher contributions to the unit-linked insurance accounts offered by PZU branches, especially IRA and the Goal for the Future products;

- constantly rising level of premiums on protection products in endowments and term insurance – the volume of sales is greater than the number of instances of reaching the endowment age, surrenders, lapses and deaths in the existing portfolio.

The investment result consists of income allocated using transfer prices and income on investment products. They rose PLN 131 million y/y in the individual insurance segment, mostly on account of the growth in the result on investment products – this was predominantly the effect of higher yields of funds in unit-linked products, in particular in the bancassurance channel, and better performance recorded in the IRA individual retirement account product. Income allocated by transfer prices remained at a similar level as in the comparable period of last year.

Insurance result in the individual insurance segment (PLN million)

Net insurance claims and benefits together with the movement in other net technical provisions were PLN 1,672 million, reflecting an increase in costs by PLN 629 million compared to 2016. This was caused by significantly higher increases in provisions, predominantly for unit-linked products in the bancassurance channel and to a lesser extent the same type of products offered within PZU’s own network (mostly IRAs). In both cases, this resulted both from an increase in customer deposits in unit-linked fund accounts and significantly better results of investment activity in the reporting period. Additionally, in 2017 the level of reversals of provisions for the restatement of benefits and litigation in the old annuity portfolio in its run-off phase was lower than in the year before.

In 2017, acquisition expenses increased in the individual insurance segment by PLN 28 million to PLN 135 million. This was driven by a significantly higher volume of sales of unit- linked products in the bancassurance channel with prepaid commissions and, to a lesser extent, by additional expenses resulting from the growing involvement of own network in the acquisition of individual protection products.

Administrative expenses in 2017 remained at a similar level as the year before, i.e. at PLN 61 million compared to PLN 59 million in the previous year.

The main factor contributing to the decline in the segment’s operating result is still the increase in commissions for unit- linked products in the bancassurance channel and increase of the share of investment products generating a much lower margin in the segment’s revenues.

Investments

The revenues of the Investments segment comprise the investments of the PZU Group’s own funds, understood as the surplus of investments over technical provisions in the PZU Group insurance companies seated in Poland (PZU, LINK4 and PZU Życie) plus the surplus of income earned over the risk-free rate on investments reflecting the value of technical provisions of PZU, LINK4 and PZU Życie in insurance products, i.e. surplus of investment income of PZU, LINK4 and PZU Życie over the income allocated at transfer prices to insurance segments.

Additionally, the investment segment includes income from other free funds in the PZU Group (including consolidated mutual funds).

Income on operating activities in the investments segment (excluding external operations) amounted to PLN 111 million and was higher than in the previous year, in particular as a result of better climate in the Polish equity and bond market, and acquisition of high-margin exposures to debt portfolios.

Banking activity

The banking activity segment consists of the following groups: Pekao, from June 2017 (effect of settling the transaction and start of consolidation) and Alior Bank.

In 2017, the banking activity segment generated PLN 2,487 million in operating profit (without amortization of intangible assets acquired as part of the bank acquisition transactions), representing an increase by PLN 1,839 million compared to 2016. Taking into consideration the commencement of consolidation of Pekao, one of the largest banks in Central and Eastern Europe, all items of the statement of profit or loss and items of the statement of financial position for 2017 are significantly higher compared to the previous year.

In 2017, Pekao has contributed PLN 1,750 million to operating profit (without amortization of intangible assets acquired as part of the Pekao acquisition transaction) in the “Banking activity” segment and Alior Bank contributed PLN 737 million.

The key element of the segment’s income is investment income, which in 2017 increased to PLN 6,506 million y/y (up 207.0% y/y).

Interest income comprises the following components: interest income, dividend income, trading result and result of impairment losses.

In 2017 very high sales of credit products were recorded in Pekao and Alior Bank, among others thanks to the favorable economic climate and the low level of interest rates.

Alior Bank recorded an increase in net interest income (interest income minus interest expenses) by 46.0% as a consequence of acquisition of a spun-off portion of Bank BPH and organic growth in the volume of loans granted to clients coupled with the accompanying increase in client deposits. As at the end of 2017, the size of the net client loan portfolio in Alior Bank grew 10.9% y/y and deposits from non- financial clients rose 12.2%.

Profitability of the banks in the PZU Group measured by the net interest margin amounted to 2.8% in Pekao (for the whole year) and 4.6% in Alior Bank (up 0.5 p.p. y/y). The difference in the level of the indicators results in particular from the structure of the loan receivables portfolio (Pekao Bank – over 40% of the housing loan portfolio and Alior Bank – over 35% of consumer loans).

The net fee and commission income in the banking activity segment amounted to PLN 1,605 million and was PLN 1,254 million higher y/y. As in the case of the net interest income, the increase in loan sales contributed to improvement of the above figures.

The segment’s administrative expenses amounted to PLN 3,754 million and comprised Pekao’s expenses in the amount of PLN 1,917 million (for 7 months) and Alior Bank’s expenses – PLN 1,837 million. In 2017, Alior Bank recorded an increase in personnel costs, which resulted among others from the pay pressure and the bank’s strategy focusing on innovative solutions requiring qualified IT staff.

In addition, other contributors to the operating result included other operating income and expenses, where the main components are the BFG fees (PLN 101 million) and tax from other financial institutions (PLN 513 million).

As a result, the Cost/Income ratio DICTIONARY stood at 48% in both banks. The ratio was 46% for Pekao and 49% for Alior Bank.

As part of consolidation adjustments pertaining to the banking segment, the following items should be highlighted in 2017:

- elimination of PLN 414 million on account of fair value restatement of previously owned shares, associated with acquisition of the remaining shares in Pekao TFI (formerly: PPIM) and Dom Inwestycyjny Xelion.

- the effect of reversal of the positive result on sales of NPL loans by Bank Pekao in the amount of PLN 143 million.

Both of the above values were allocated to the Bank Pekao purchase price.

Pension insurance

In 2017, the operating profit in the pension insurance segment amounted to PLN 87 million, i.e. it increased by 17.5% compared with 2016. The major drivers of the operating result included the following:

- commission and fee income shot up 16.0% compared to the previous year and stood at PLN 128 million. This change was the result of:

- management fee up by PLN 18 million as a result of the higher average net asset value in OFE PZU;

- revenues down by PLN 3 million on reimbursements from the Indemnity Fund;

- increase in income on withdrawal of funds from the reserve account by PLN 2 million.

- acquisition and administrative expenses stood at nearly PLN 3 million, having declined by 28.2% from the previous year. This resulted from OFE’s information activities in 2016;

- administrative expenses hit PLN 44 million, i.e. they were up 8.2% from the previous year. This change resulted mainly from increased costs:

- due to the payment of contributions to the Indemnity Fund by over PLN 2 million; and

- personnel costs mainly due to higher bonus costs and changes in the employment structure.

- other operating income dropped by nearly over PLN 3 million due to the business events that took place in 2016, i.e.: receipt of the incentive bonus (PLN 2 million), restatement of the provision for refund of contributions overpaid by ZUS and reversal of the provision for mailing the annual fund information for 2015 (PLN 1 million).

Operating profit in the pension insurance segment (PLN million)

Baltic States

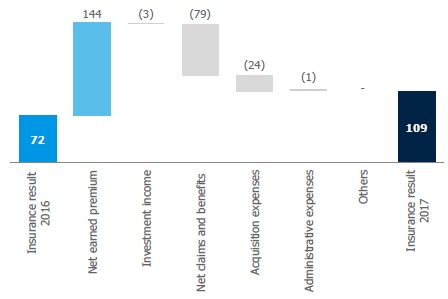

In 2017, the PZU Group’s business in the Baltic states generated a positive insurance result of PLN 109 million compared to PLN 72 million in the previous year. This result was shaped mainly by the following factors:

- increase in gross written premium. It amounted to PLN 1,404 million compared to 1,183 in the year before. The premium in non-life insurance increased by PLN 214 million y/y (or 18.9%). Such a dynamic increase was possible among others thanks to increase in the motor insurance premiums in the region, increase in the sale of property insurance – both in Lithuania and in Latvia, where the entities intensified their sales, and significant increase in the premium written in health insurance in Latvia. Premiums in life insurance increased by PLN 7 million (or 13.7%);

- decrease in investment income. In 2017 the result stood at PLN 20 million and was 13.0% lower than in the year before, primarily as a result of lower increase of investment property prices;

- increase in net claims and benefits. They amounted to PLN 773 million and were higher by PLN 79 million compared to the year before. At the same time the loss ratio in non-life insurance stood at 61.2%, down 0.8 p.p. from the previous year. In life insurance the value of benefits stood at PLN 45 million and was 9.8% higher than in the previous year;

- higher acquisition expenses. They segment’s expenditures for this purpose were at PLN 275 million. The acquisition expenses growth rate was lower than the premium growth rate and stood at 9.6% y/y. The acquisition expense ratio calculated on the basis of net earned premium dropped by 0.7 p.p. and stood at 22.0%;

- slight increase in administrative expenses. They were PLN 111 million, increasing by 0.9% from the previous year. Despite an increase in incurred expenses, a decrease in the administrative expense ratio was recorded, standing at 8.9%, down 1.1 p.p. relative to 2016. The lowering of administrative expenses was possible due to the maintenance of cost discipline, notably in the IT area.

Insurance result in the Baltic States segment (PLN million)

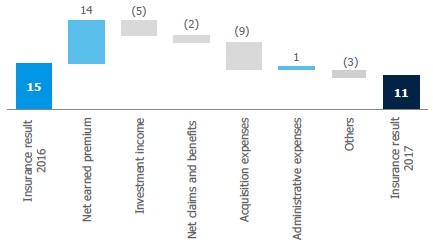

Ukraine

The Ukraine Segment closed 2017 with a positive insurance result of PLN 11 million, compared to PLN 15 million last year.

The change in the result generated by the segment was caused by the following factors:

- growth of gross written premium. It amounted to PLN 223 million and increased compared to the previous year by PLN 13 million (or 6.2%). The increase in non-life insurance premiums (4.6% y/y) occurred primarily in motor insurance, both as a result of increasing sums insured and tariffs in mandatory insurance. Premiums in life insurance increased by PLN 5 million (or 13.5%);

- lower income from investing activities. The segment generated PLN 18 million, which was 21.7% less than in 2016. This resulted from, among others, positive foreign exchange differences in the portfolio of USD-denominated investments including in investment income in the previous year;

- increase in net claims and benefits. These reached PLN 56 million and were 3.7% higher than in the previous year. In life insurance the value of benefits paid decreased in relation to the previous year by PLN 4 million (or 19.0%). The loss ratio calculated on the basis of the net earned premium in non-life insurance was 47.0%, up 2.4 p.p. compared to the previous year;

- increase in acquisition expenses. They stood at PLN 69 million compared to PLN 60 million in the previous year. Due to the higher commission burden, expenditures for this purpose in life insurance increased by PLN 6 million (or 31.6%). The segment’s acquisition expense ratio went up compared to the previous year by 1.1 p.p. to 56.1%;

- decrease in administrative expenses. They amounted to PLN 23 million, down PLN 1 million compared to the previous year. The administrative expense ratio calculated on the basis of the net earned premium decreased by 3.3 p.p. and stood at 18.7%.

Insurance result in the Ukraine segment (PLN million)

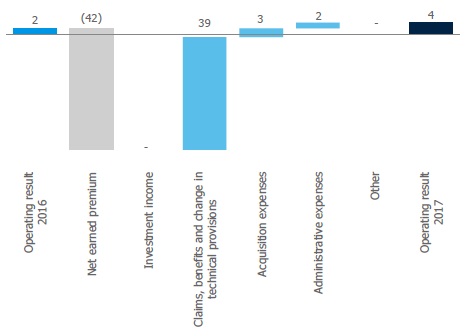

Investment contracts

In the consolidated financial statements investment contracts are recognized in accordance with the requirements of IAS 39.

The results of the investment contracts segment are presented according to Polish Accounting Standards, which means that they include, among other things, gross written premium, claims paid and movement in technical provisions. The above categories are eliminated at the consolidated level.

In 2017 the PZU Group earned PLN 4 million of operating profit compared with PLN 2 million in the previous year (increase of 100.0%) on investment contracts, i.e. PZU Życie’s products which do not generate a material insurance risk and which do not meet the definition of an insurance contract (such as some products with a guaranteed rate of return and certain unit-linked products). This result in 2017 was driven by the following factors:

- gross written premium generated on investment contracts in 2017 decreased by PLN 42 million (-48.8%) compared to the corresponding period in 2016 to PLN 44 million. The changes in gross written premium were caused mainly by the withdrawal of short-term endowment insurance products (term deposits packaged as insurance products) from own channel offering in June 2016;

- result on investing activity in the investment contracts segment remained on an unchanged level vis-à-vis the previous year, i.e. at PLN 18 million;

- the cost of insurance claims and benefits together with the movement in other net technical provisions decreased PLN 39 million y/y to PLN 50 million due to the withdrawal, in mid-2016, of short-term endowment products from the range of products offered in the own channel (the absence of written premium as opposed the previous year does not generate any growth in technical provisions, while the value of benefits paid to persons reaching the endowment age is offset by a commensurate movement in technical provisions);

- the decrease in acquisition expenses vis-à-vis the previous year was an effect of the lack of new sales and declining value of assets in unit-linked products in the bancassurance channel (a portion of the bank’s fee depends on the level of assets) and additionally also a declining involvement of the company’s own network in selling short-term investment endowment products following the withdrawal of products of this type from the offering in June 2016;

- administrative expenses totaled PLN 7 million, down 22.2% from the corresponding period of 2016 as a result of a decrease in the portfolio of agreements in this segment.

Summing up, the increase in the segment’s operating result was driven mainly by the lower operating expenses allocated to the products of this segment.

Operating result in the investment contracts segment (PLN million)

Profitability ratios

In 2017 the return on equity attributable to the parent company (PZU) was 21.1%. ROE was 6.2 p.p. higher than in the prior year. The profitability ratios achieved in 2017 by the PZU Group exceed the levels achieved by the whole market (according to the data for three quarters of 2017).

Operational efficiency ratios

One of the fundamental measures of operational efficiency and performance of an insurance company is COR – Combined Ratio – calculated, due to its specific nature, for the non-life insurance sector (Section II).

The PZU Group’s combined ratio (for non-life insurance) has been maintained in recent years at a level ensuring a high profitability of business. In 2017, the ratio declined mainly due to the lower loss ratio in agricultural insurance as a result of the occurrence of numerous losses caused by forces of nature (adverse effects of ground frost) in 2016.

The operating efficiency ratios, broken down into individual segments, were presented in the ATTACHMENT.