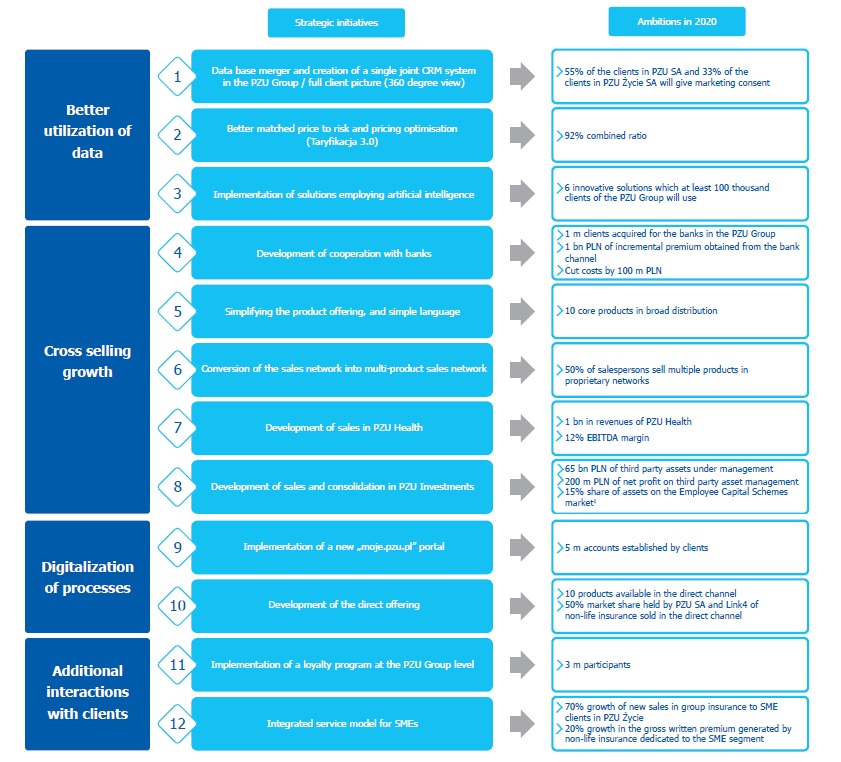

Strategy operationalization

Strategy

12 key initiatives form the foundation of the New PZU. The key operational performance indicators and the initiatives to support their execution have been described below.

1 Objective to be confirmed after the enactment of the Act on Employee Capital Schemes

#1 Joint CRM

The combination of PZU’s databases under a single CRM (customer relationship management) system will make it possible to customize the offer to client needs more effectively in terms of quality and costs alike. This will also accelerate the purchase process while streamlining service-related processes. Clients will be able to manage their products in the entire PZU Group quickly and easily (on their own or by using the support of advisors).

Having a full client picture (360 degree view) will assist us in cultivating client relations while enabling us to standardize processes, grasp client needs better, underwrite risk in an optimum fashion, pursue more effective cross-sales efforts and manage the sales network more efficiently.

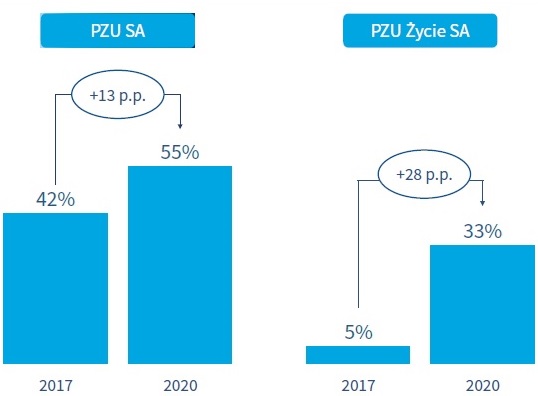

Percentage of marketing consents and client contact data obtained in PZU and PZU Życie

#2 More effective tariff setting

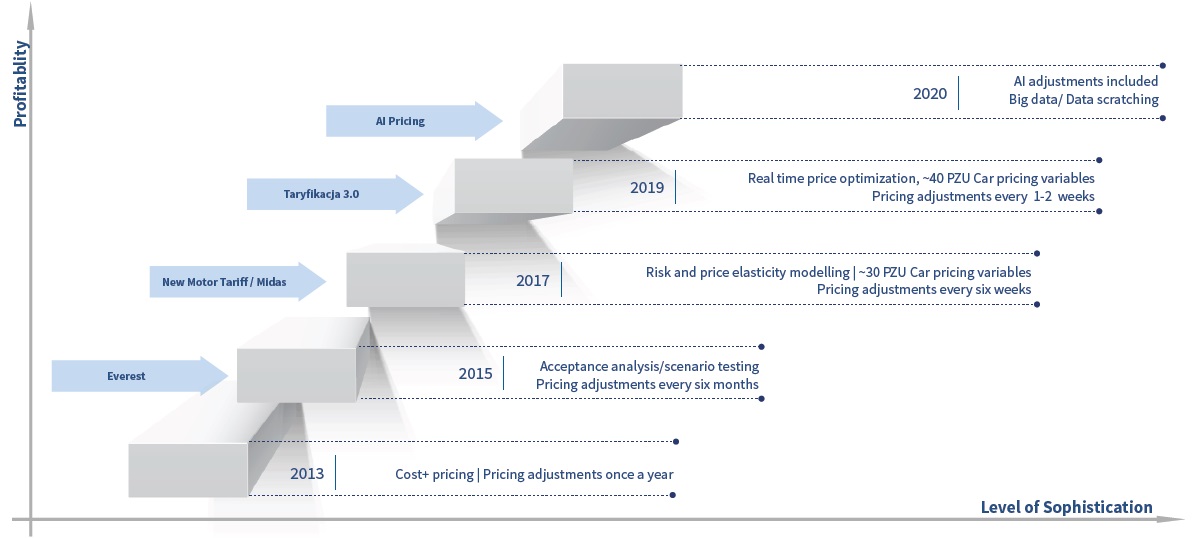

The Everest sales platform began to operate in 2015, allowing PZU to adapt its tariffs every 6 months (previously once a year). In 2017 this process was truncated to approximately 6 weeks. By the end of 2019 tariffs will be subject to optimization in real time, while the models themselves will undergo adjustment once every 1-2 weeks. This will open the path to the more extensive utilization of artificial intelligence models in tariff processes in 2020.

Better matched price to risk and price optimisation (Tariff setting 3.0)

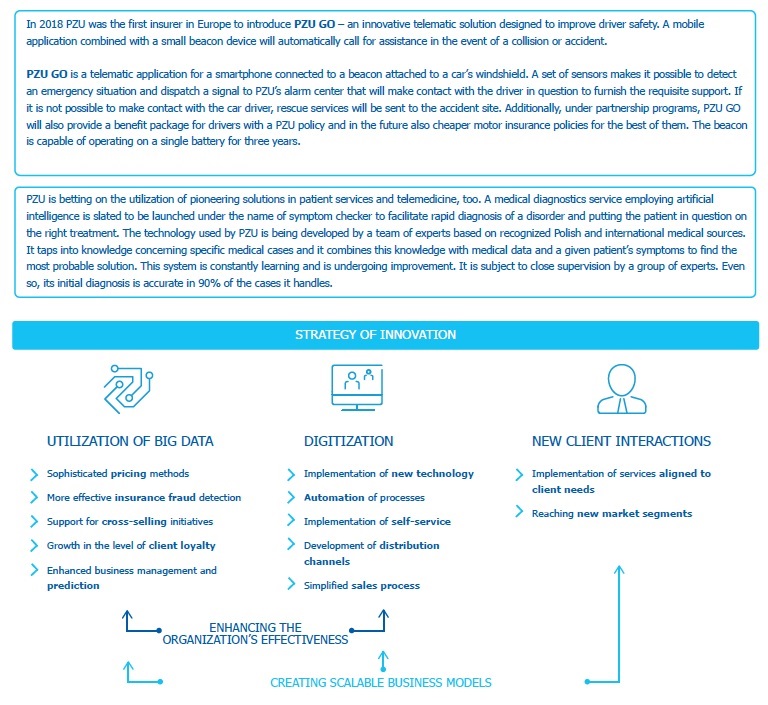

#3 Artificial intelligence

PZU intends to utilize the know-how and the best technological solutions in operation within the PZU Group while actively looking for new solutions enabling it to construe permanent advantages. Collaboration with the startup community (insurtech, fintech, technological firms) will act as one of the sources. The first business areas to benefit from these changes will be as follows: setting tariff rates and risk management, sales, client retention and claims administration as well as medical diagnostics.

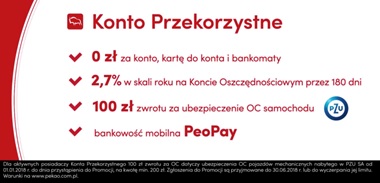

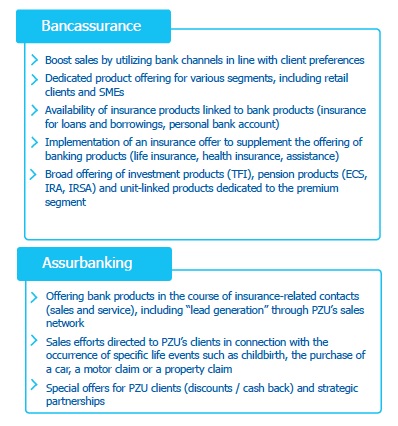

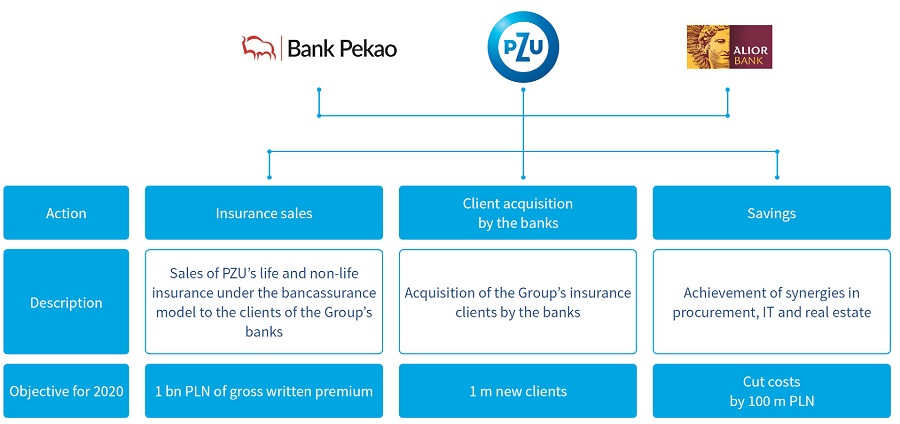

#4 Cooperation with banks

Cooperation with the banking segment will form a plane for PZU to build lasting client relations. Its ambitious targets entail the sales of insurance to the clients of Bank Pekao and Alior Bank as well as PZU bringing insurance clients as new clients to these banks. The potential to generate cost savings has also been identified as a result of creating an integrated real estate administration system and a joint procurement model.

Cooperation with the banking segment will form a plane for PZU to build lasting client relations. Its ambitious targets entail the sales of insurance to the clients of Bank Pekao and Alior Bank as well as PZU bringing insurance clients as new clients to these banks. The potential to generate cost savings has also been identified as a result of creating an integrated real estate administration system and a joint procurement model.

Development of cooperation with banks

The PZU Group’s long-term strategic objective is to retain its leading position in the banking sector in Poland. By 2020 the Group will have at least 300 bn PLN in assets, while the banking segment’s net financial result will form a contribution to the PZU Group’s result of at least 900 m PLN.

Strategic partnerships

Cooperation under a banking model, its strong market position, brand recognition and its strategic objective of creating an ecosystem in which the overriding objective is to manage client relations skillfully by offering clients solutions in all venues accessible to clients will contribute to intensifying activities in strategic partnerships with companies operating on the Polish market.

On 9 January 2018 (i.e. the date of publishing the “New PZU” strategy) PZU reported that it has established cooperation with PLL LOT and Allegro.

PZU’s strategic cooperation with PLL LOT rests on two pillars. The first one is for PZU to furnish a full spectrum of insurance and services customized to the needs and expectations of PLL LOT’s clients during their travels. This will entail travel insurance, other assistance and concierge services in channels for the distribution of PLL LOT’s air tickets. Travel insurance will be embellished with elements related to medical services. The second area of PZU’s strategic partnership with PLL LOT will involve extensive corporate collaboration.

PZU also entered into a strategic partnership with Allegro - the internet sales leader in Poland. Cooperation will involve several elements. The most important ones will be the sales and distribution of innovative, fully digital insurance products customized to the specific nature of the needs of buyers and sellers on the allegro.pl service. PZU intends to conduct technological and service-related integration with Allegro’s processes. Matters related to service and claims handling will be the next areas of cooperation.

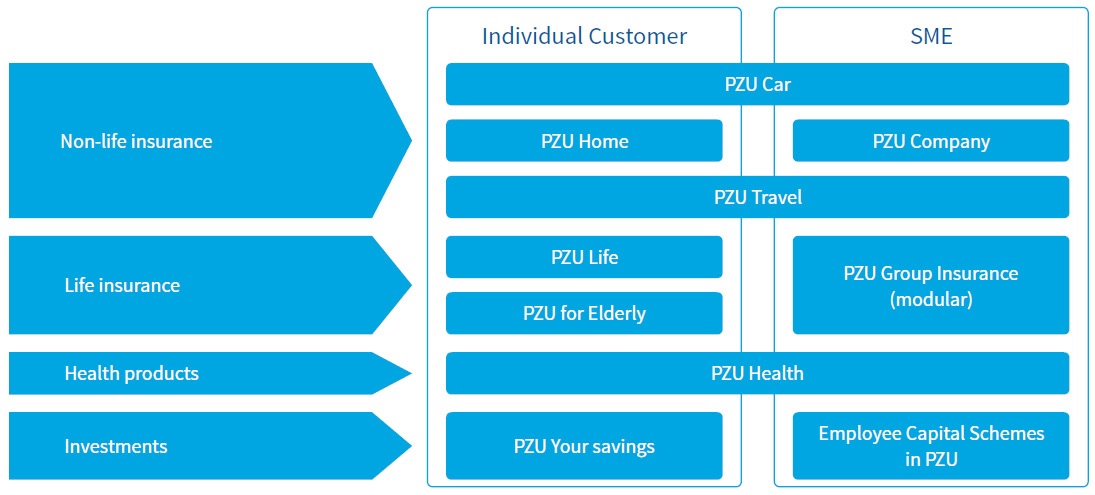

#5 Simplifying the product offering

PZU will simplify its product offering in respect of the number of products and the language used (straightforward language). This will make it possible for general sales people (#6 below) to sell effectively while helping clients choose the right product. Our offer (also available in the Internet) will consist of 10 widely distributed products.

Simplifying the product offering, and simple language

#6 Converting the sales network into a general sales network

PZU will utilize the potential of the financial market’s largest proprietary distribution network. By 2020 our general sales proprietary network operating in Poland under the PZU brand (i.e. channels fully controlled by the PZU Group: branches, tied agents in life and non-life insurance and the corporate sales network) will consist of approximately 5 thousand general sales people (i.e. 50% of the Group’s proprietary network). A general salesperson will offer at least 3 of the 5 lines of business (life insurance, non-life insurance, medical care, investment products, banking products).

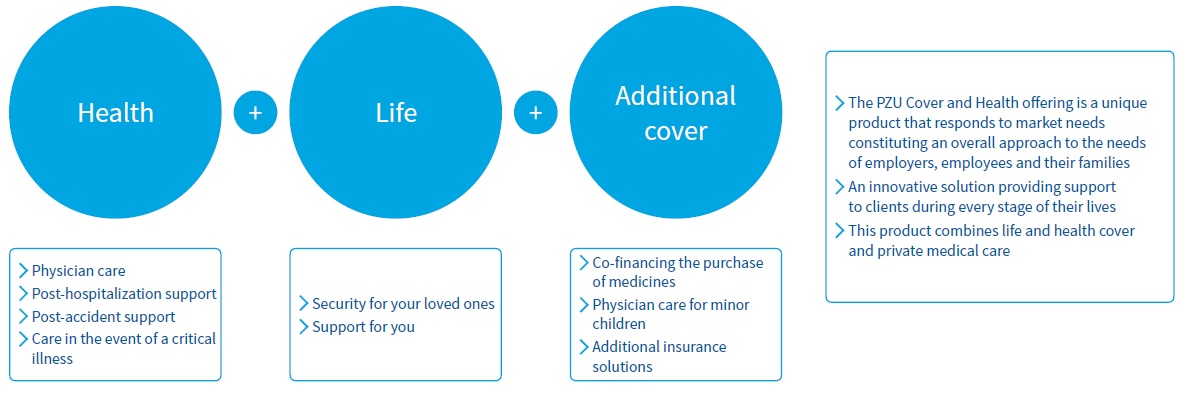

#7 Development of sales in PZU Zdrowie

In Health the PZU Group intends to grow sales by developing new health insurance products and expanding its “traditional” offering to include unique riders. Additional support will be provided by making the sales network more active and tapping into the full potential of the of the PZU Group’s client base. The plan is for PZU to administer 4 million health insurance agreements in 2020; this area’s revenues will hit the PLN 1 billion, while its EBITDA margin will be equal to 12%.

We will build a lasting competitive edge by employing modern patient service processes giving consideration to the best-in- class market practices, innovative technological and medical solutions and high quality of service standards, including VIP care. We will continue to develop our proprietary branch network, among others, by pursuing greenfield projects and M&A efforts.

We will offer unparalleled solutions blending insurance cover with medical care

PZU will build a new patient care model providing for optimum quality and the utilization of new technology. Patients will have their symptoms checked quickly, their diagnosis will be confirmed along with their treatment plan. Mobile solutions and artificial intelligence (symptom checker) will offer convenience while immediately solving problems. PZU developed a platform in cooperation with a Polish technology start-up, which is available on the patient portal, in an application and also in the form of a dedicated solution for medical hotline employees. The purpose of the platform is to conduct a patient check-up, which is very similar to when a physician conducts an examination, followed by presenting the most probable solution and defining the next steps. This may be phone consultation, video consultation or a chat with a doctor or a visit in a clinic to with a specific specialist. However, in many cases such a discussion with a patient may come to an end with advice being given or a prescription being sent, without needing to leave home.

On top of a rapid diagnosis, PZU will give a guarantee of there being no waiting lines to see a physician. The waiting time to see a primary care physician should be no longer than 2 days, while the waiting time to see a specialist should be no longer than 5 days. This will be possible, among other things, thanks to our expanded medical network consisting of proprietary and partnership centers – a total of 2,000 centers in 500 cities. PZU also offers the possibility of being treated by a physician outside the network, and of having tests on the basis of a booking given by physicians from outside PZU Zdrowie’s network.

Prophylactics and prevention coupled with encouraging people to lead a healthy lifestyle are an important aspect of the operation of PZU Zdrowie. Prevention campaigns are supposed to augment the effects while minimizing the consequences of possible damages. Every year PZU checks which dangers pose the greatest threat to Poles. For that and other reasons, it organizes testing of children in schools and it invests in educating people about health care. It also helps organize care for senior citizens, it provides support for innovative methods to detect tumors and it collaborates effectively with oncology centers.

#8 Development of sales and consolidation in PZU Investments

PZU will roll out a uniform asset management structure in the PZU Group making it possible, among others, to achieve cost synergies (one investment product “factory”). The development of new investment products (inter alia, lifecycle funds and low-cost passive funds) and of new distribution channels (direct), also entering international markets is also being planned.

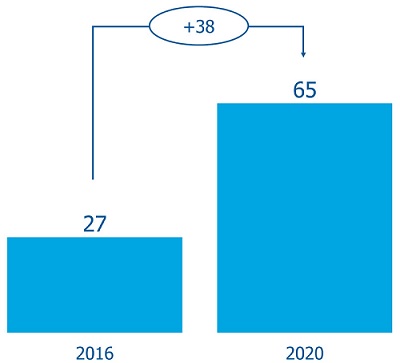

Third party assets (PLN billion)

PZU will utilize the changes ensuing from the reform of the pension system - Employee Capital Schemes in which it intends to attract a 15% market share measured by market assets.

In 2020 the third party assets under management in the PZU Group will expand to PLN 65 billion, while the net result on third party asset management will hit the level of PLN 200 million.

#9 Implementation of a new „moje.pzu.pl” portal

PZU will radically change client interactions with its current client portfolio (11 m clients in life insurance and 6 m clients in non-life insurance) by integrating all its services under a single portal called “moje.pzu.pl”. It will be a one-of-a-kind dashboard enabling clients to familiarize themselves with their insurance cover at any given moment in time, manage their health cover and appointments and manage their investments - also to include banking in the future. 5 million clients will open an account in the „moje.pzu.pl” portal by 2020.

The ability to enter into an agreement through the online channel will mean that this portal / application will ultimately be used by all PZU clients.

#10 Development of the direct offering

PZU will develop the best sales site in the online channel among European insurers. Transparent and straight-forward products (#5 above) will be offered through this service, while PZU will be the unchallenged leader in the direct sales channel with a market share of at least 50%.

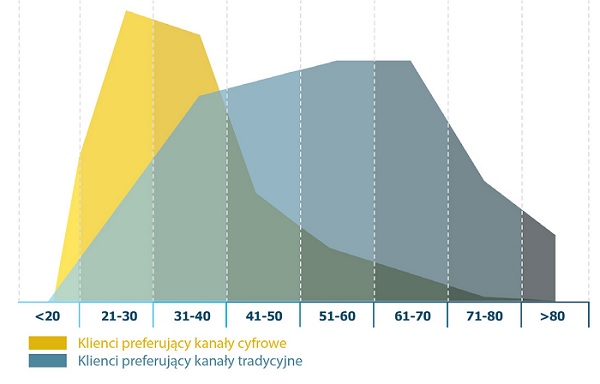

Reaching clients who prefer digital channels

#11 Loyalty program

PZU will launch a loyalty program for the overall Group spanning all its products. The points collected by using these services as well as other activities (among others having a claim-free history and referring the program to a friend) may be converted into products and services from our partners. The program is supposed to make it possible to share points with family members and hold auctions among the participants. This program will make it possible to grow the number of client interactions while expanding its range and reach to find new target client groups (also the possibility of attracting young clients) and customizing its offering better. This is also tantamount to building client relations that do not always have to end in the form of a sale. Club members will be encouraged to get involved in activities to benefit the local communities in which they live. They will have the possibility, for example, of voting for projects under the program entitled “Helping is Power” - a nationwide prevention campaign addressed to local communities. PZU will get involved in particular in those initiatives that obtain extensive endorsement among club members.

The number of participants in PZU’s loyalty program in 2020 will be 3 million.

#12 Integrated service model for SMEs

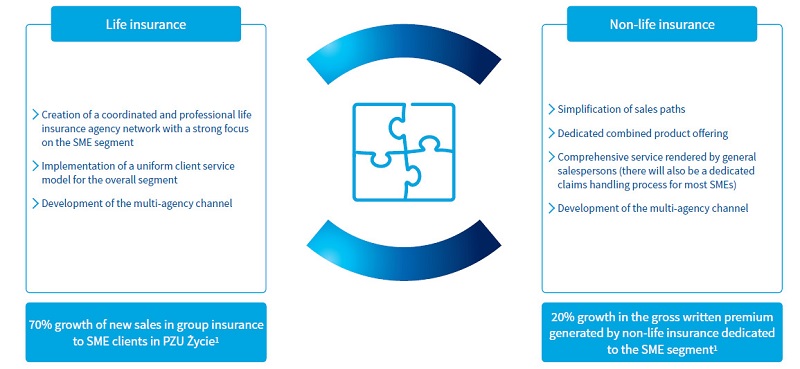

PZU will ramp up sales of group and property insurance to the small and medium enterprise segment (SME). Activities will be concentrated on reorganizing and unifying the sales and service model, developing its multi-agency channel and creating dedicated product offerings for the SME segment.

This new approach will facilitate 70% growth of new sales in group insurance to SME clients in PZU Życie and 20% growth of gross written premium on property insurance dedicated to the SME segment.

Integrated service model for SMEs

1 Value generated in 2020 compared with 2016