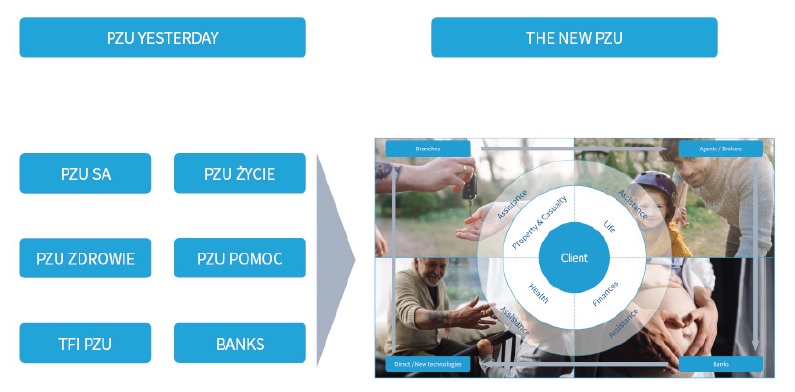

New operating model

Strategy

PZU has approximately PLN 300 billion of assets under management and it renders services to 22 million clients in five countries. The Group companies are active not only in life and non-life insurance but also in investment, pension, health care and banking products. Moreover, it renders assistance services to retail clients and businesses through strategic partnerships. The magnitude and variety of operations paint the larger picture of what PZU is. It is a powerful financial institution, but above all it is a group of service companies whose operating foundation is the trust of its clients.

“By defining the PZU Group’s mission anew, we have drawn conclusions from our own experience on one hand while pointing to the direction in which the entire industry will move on the other hand. We would like to do something different from the classical client relation model insurers follow in which the only contact clients have with their insurer after buying a policy is when a claim occurs. We want to do considerably more and effectively help clients solve their problems in many areas and during every stage of life. PZU’s new approach to building client relations are in the heart of this change.

(...) PZU’s clients make many important decisions that greatly influence their future security on top of their attempts to afford themselves, their loved ones, their firms and their employees insurance cover in their daily lives. The PZU Group wants to be part of all that – we want to help our clients make wise choices to protect their lives, health, assets, savings and finances. We want to give them tools to help them protect what is the most valuable to them. The New PZU is much more than insurance.” – Paweł Surówka, CEO of PZU, 9 January 2018

The PZU Group’s new mission has been defined in this spirit.

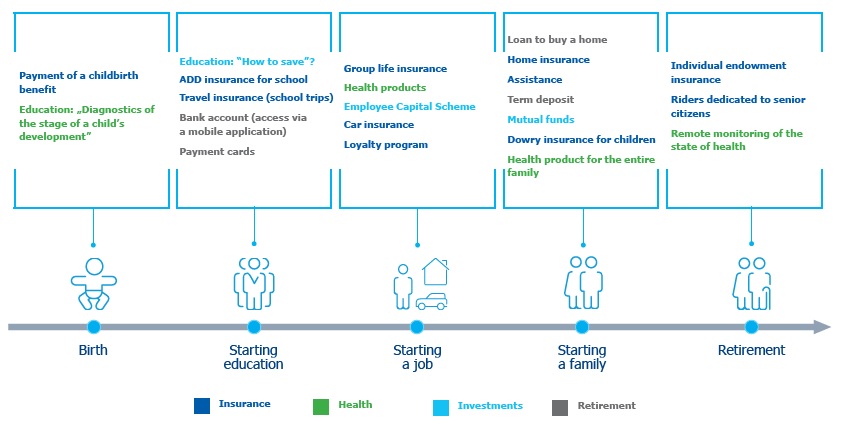

PZU’s philosophy of thinking about clients constitutes a departure from the classic model of an insurer’s client relations rooted solely in sales and after-sales service. PZU’s goal is to establish and maintain relations by delivering products well-matched to clients at the appropriate time and place so as to ensure at the same time that the product’s attributes (including its price) are aligned to client needs.

Ultimately, PZU intends to unite all the company’s areas under a client focus so as to be able to address client needs comprehensively. Achieving a high degree of quality and number of client interactions has required the creation of a new model in which the core is client knowledge and the skill of building long-term relations. Special emphasis will be placed on analyzing the information the PZU Group has to grasp and use it better. To this end, areas in which tools rooted in artificial intelligence, big data and mobile solutions will be used have been defined.

We are changing PZU – we are becoming a lifetime partner

“Defining PZU as a company that helps clients on an everyday basis calls for considerable investments in the overall Group’s growth. Our client relationships and our knowledge of our clients are becoming our main value, while our chief product is our acumen in addressing client needs to build a stable future. That is why we devote so much space in this strategy to initiatives that will enrich our client knowledge and assist us in reaching clients even more quickly.”– Paweł Surówka, CEO of PZU, 9 January 2018

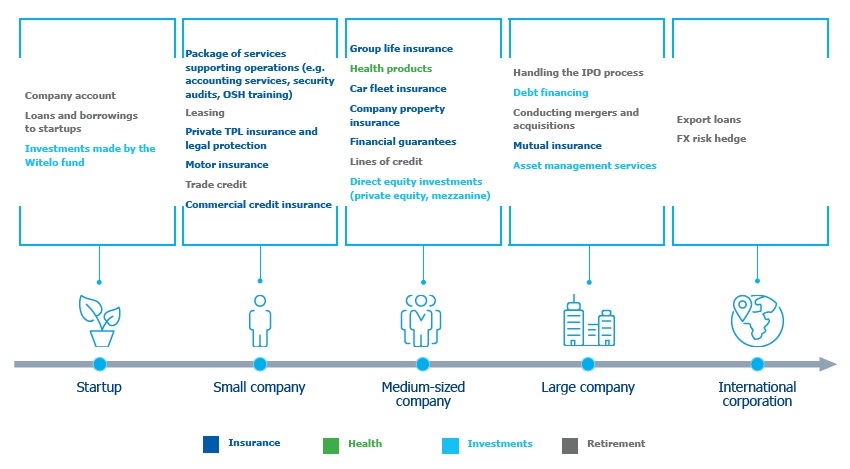

The philosophy of how sales networks operate will also change. The PZU Group calls for abandoning “product centricity” in favor of an ecosystem whose overriding objective is to manage client relations skillfully by offering solutions in all venues available to clients. Accurately anticipating the future, understanding client needs and building every better methods of becoming part of their daily lives are the logical grounds underpinning other initiatives in PZU’s new strategy. Among others, these initiatives include radically simplifying our product offering and poising our sales network to offer all our products and services, investing in database integration to procure a full picture of our clients, cross selling, offering a loyalty program and reducing the age of our client base. Tightening cooperation with the Alior and Pekao SA banks is also an important issue whereby we will be able to devise comprehensive financial solutions responding to the needs of retail clients and small and medium-sized companies. (more: CHAPTER 4.4. STRATEGY OPERATIONALIZATION)

We will be a long-term partner for our clients.

We help companies grow by offering them a wide array of products supporting their growth.

Sustainable development

PZU is planning its current and future actions based on responsible management in financial, employee, social, environment, human rights and anti-corruption areas (REPORT ON NON-FINANCIAL INFORMATION OF THE PZU GROUP AND PZU SA FOR 2017) Representation concerning non-financial information). That is why operating processes in every stage of preparing, distributing and handling products are conducted while taking into account the principles of sustainable development and the best practices adopted by the Group. Its responsible approach to business is one of the key pillars for building long-term and partnership contacts that will be conducive to building mutual understanding and trust.

Values by which we are guided in our actions