Major factors contributing to the consolidated financial result

In 2017, the PZU Group generated a result before tax of PLN 5,526 million compared with PLN 2,988 million in the previous year (up 84.9%). Net profit reached PLN 4,233 million and was PLN 1,859 million more than in 2016. Net profit attributable to the parent company’s shareholders was PLN 2,910 million compared to PLN 1,935 million in 2016 (up 50.4%).

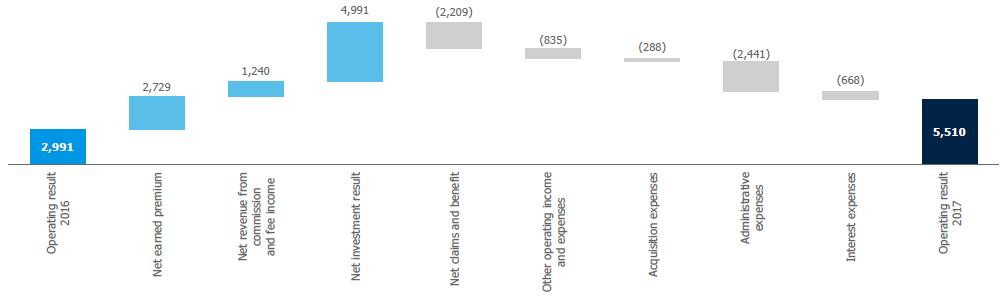

The net result increased 97.5% compared to last year, net of non-recurring events. The operating profit in 2017 was PLN 5,510 up by PLN 2,519 million compared to 2016.

Operating profit was driven in particular by the following factors:

- higher gross written premium in motor insurance in the mass and corporate client segments following an increase in average premium and in individual insurance, in particular unit-linked products in the bancassurance channel;

- the increase in profitability in the mass insurance segment associated mainly with a decrease in the loss ratio in agricultural insurance – in the corresponding period of the previous year, occurrence of numerous losses caused by forces of nature (adverse effects of ground frost) and, to a smaller extent, improvement of profitability in motor insurance;

- lower profitability in the corporate insurance segment, mainly in the non-motor insurance product group following the reporting of a few claims with high unit values;

- the decrease in profitability in group and individually continued insurance as a result of a higher loss ratio in protection products driven by the increase in the frequency of events associated with deaths in Q1 2017 and as a result of the absence of the non-recurring factor from 2016 involving an update in the assumption on future disbursements applied to the calculation of provisions;

- better performance in the banking segment: Alior Bank in connection with the high sales level of credit products supported by good business climate;

- higher investment income on equity portfolios due to an upswing on the Warsaw Stock Exchange, including a higher valuation of the stake held in the Azoty Group.

The key events in 2017 included adding the Bank Pekao (hereinafter: Pekao) group to the PZU Group’s structures. This transaction transformed the PZU Group from being an insurance group into a financial group. The commencement of consolidating Pekao in June 2017 materially affected the comparability of the results and the total balance sheet value. The total balance sheet value jumped on this account by roughly PLN 192 billion compared to the previous year, while non-controlling interests totaled PLN 23.0 billion (as at 31 December 2017). Since the consolidation of Pekao commenced in June 2017, it contributed PLN 1,502 million and PLN 1,750 million to the operating result of the PZU Group and the bank segment respectively.

In the individual operating result items, the PZU Group posted:

- increase in gross written premium to PLN 22,847 million. When compared to the previous year, premium rose by 13.0%, mainly in the motor insurance group in the mass and corporate client segments following an increase in average premium and in individual insurance, in particular unit-linked products in the bancassurance channel. After considering the reinsurers’ share and movement in the unearned premium reserve, the net earned premium was PLN 21,354 million and was 14.7% higher than in 2016;

- higher net result on investing activity, including an increase in investment income earned on the banking activity following the commencement of consolidation of Pekao SA, but also a higher net result on investing activity excluding banking activity.

- The net result on investing activity was PLN 8,502 million, up 142.2% compared to 2016. Investment income excluding banking activity rose mainly because of the better performance posted on listed equity instruments, in particular due to the improved market conditions on the Warsaw Stock Exchange. A positive change was also recorded in comparison to the corresponding period of the previous year due to the improved valuation of the equity stake in Azoty Group in the long-term asset portfolio;

- increase in interest expenses to PLN 1,365 million vs. PLN 697 million in the corresponding period of the previous year, associated in particular with the commencement of consolidation of Pekao and PZU’s PLN 2,250 million issue of subordinated bonds in June 2017;

- higher level of claims and benefits paid. They amounted to PLN 14,941 million, which means a 17.3% increase compared with 2016. The increase occurred in particular in the class of insurance against losses caused by the forces of nature, individual unit-linked products in the bancassurance channel and in motor insurance, as a result of the growing insurance portfolio;

- higher acquisition expenses (a PLN 288 million increase) in both mass and corporate client segments, driven up mainly by higher sales;

- the increase in administrative expenses to PLN 5,364 million from PLN 2,923 million in 2016 was associated with the commencement of consolidating Pekao and Alior Bank’s merger with the spun-off portion of BPH on 4 November 2016. Administrative expenses of the banking segment rose by PLN 2,464 million. At the same time, the administrative expenses of the insurance segments in Poland were PLN 10 million lower compared to the previous year. The change resulted from lower expenses of project activity partially offset by the higher expenses incurred in bancassurance products following a change in the rules of settlements with banks under bancassurance agreements;

- higher negative balance of other operating income and expenses of PLN 1,559 million. This change was caused mainly by the higher level of levy on financial institutions. The total burden incurred by the PZU Group on account of this tax (in insurance and banking activity) in 2017 was PLN 822 million, as compared to PLN 395 million in 2016 (as a result of the commencement of consolidating Pekao and the introduction of the tax since February 2016). Moreover, in 2016, a non-recurring gain was recognized on the bargain acquisition of a spun-off portion of BPH in the amount of PLN 465 million, partially offset by the restructuring provision at Alior Bank in the amount of PLN 268 million.

1 Non-recurring events include the conversion effect caused by converting longterm policies into yearly renewable term agreements in type P group insurance,

claims caused by weather conditions (storms), which were higher than the average of the last 3 years, claims in agricultural insurance, which were, in the comparable period, higher than the average of the last 3 years, updated assumptions as to future disbursements applied to the calculation of provisions,

profit from the bargain purchase of a spun-off portion of BPH, cost of the restructuring provision in Alior Bank.

Key data from the consolidated profit and loss account

| Key data from the consolidated profit and loss account | 2017 | 2016 | 2015 | 2014 | 2013 |

| (PLN m) | (PLN m) | (PLN m) | (PLN m) | (PLN m) | |

| Gross written premium | 22 847 | 20 219 | 18 359 | 16 885 | 16 480 |

| Net earned premium | 21 354 | 18 625 | 17 385 | 16 429 | 16 249 |

| Net revenues from commissions and fees | 1 784 | 544 | 243 | 351 | 299 |

| Net investment result | 8 502 | 3 511 | 1 739 | 2 647 | 2 479 |

| Net insurance claims and benefits | (14 941) | (12 732) | (11 857) | (11 542) | (11 161) |

| Acquisition expenses | (2 901) | (2 613) | (2 376) | (2 147) | (2 016) |

| Administrative expenses | (5 364) | (2 923) | (1 658) | (1 528) | (1 406) |

| Interest expense | (1 365) | (697) | (117) | (147) | (104) |

| Other operating income and expenses | (1 559) | (724) | (419) | (370) | (220) |

| Operating profit (loss) | 5 510 | 2 991 | 2 940 | 3 693 | 4 119 |

| Share in net profit (loss) of entities measured by the equity method | 16 | (3) | 4 | (2) | 1 |

| Gross profit (loss) | 5 526 | 2 988 | 2 944 | 3 692 | 4 120 |

| Income tax | (1 293) | (614) | (601) | (724) | (826) |

| Net profit (loss) | 4 233 | 2 374 | 2 343 | 2 968 | 3 295 |

| Net profit (loss) attributable to equity holders of the parent company | 2 910 | 1 935 | 2 343 | 2 968 | 3 293 |

* restated data for the period 2013 - 2016

Operating result of the PZU Group in 2017 (PLN million)